Inspired by the Social Business Philosophy of Dr. Muhammad Yunus

At the heart of the Microcredit Bank concept is a revolutionary idea: banks not only fund development, but they can do so in a way that puts them at the center of creating true development. This new way of thinking did not come easily. It is the result of years of experimentation, ethical thinking, and policymaking, all grounded in the Social Business philosophy developed by Professor Muhammad Yunus.

The microcredit movement created by Professor Yunus is a powerful yet simple idea: poor people in developing countries are not “unbankable” – in fact, it is quite the opposite: the traditional banking system is simply not designed to serve them. The microfinance movement showed that financial services designed with social goals in mind can be effective and sustainable. The microloans had a high repayment rate, required no charity, and were a huge success. The microcredit movement created a new way of thinking, leading to the concept of Social Business: why should a business earn money only, rather than use it to increase its social impact?

The Microcredit Bank takes Professor Yunus’s philosophy a step further by integrating it into a bank’s very DNA. Instead of relying on traditional development models such as aid agencies, NGOs, or donors, which can often lead to a piecemeal, disorganized process, the Microcredit Bank puts banks at the heart of social change. It does so by leveraging what banks already do best: their size, professional workforce, risk management capacity, national presence, governmental supervision, and stability.

Most importantly, this initiative is not about asking banks to donate to charity. In fact, Dr. Yunus’s Social Business approach has always believed that charity is not an effective or sustainable way to bring about development in our societies. What Microcredit Bank is proposing is something much more significant: changing banking laws so that tackling social issues becomes an integral part of a bank’s regulated activity. These goals are not treated as ‘projects’ in a bank’s corporate social responsibility program; they are integrated into banking laws, organizational structures, and performance evaluations.

This approach of engaging banks as integral partners rather than distant or occasional supporters transforms development from a series of episodic efforts into a long-term, structural approach. It transforms finance from an activity that merely moves money to one that advances human-centered development in a meaningful way. This is achieved in a manner supported by legal frameworks, ethics, and financial discipline. In this way, Microcredit Bank seeks to bring to life Dr. Yunus’s dream of a world in which markets serve society's purpose rather than operate by chance.

Why Traditional Banking Laws Fall Short

Most banking laws in most countries of the world were originally based on a very narrow set of goals: maximizing profits for shareholders, protect shareholders’ interests, and avoid risk. This is how banks make lending decisions: they lend based on collateral, credit history, or asset ownership. And yet, billions of people in our societies, as well as mission-driven businesses, find themselves left out by this approach.

And yet, despite the goodwill of the bank, they’re caught in a system that says that social goals are something extra, something outside of the regular banking business. So, the attempt to do good for the community becomes a CSR program or a small philanthropic effort. It’s often marginalized from the regular banking business, dependent on optional funding, and easily forgotten if priorities shift or leadership changes.

The lack of this law was not an oversight. It was a product of an outdated belief that money and mission must be kept separate. The Microcredit Bank initiative challenges that outdated belief.

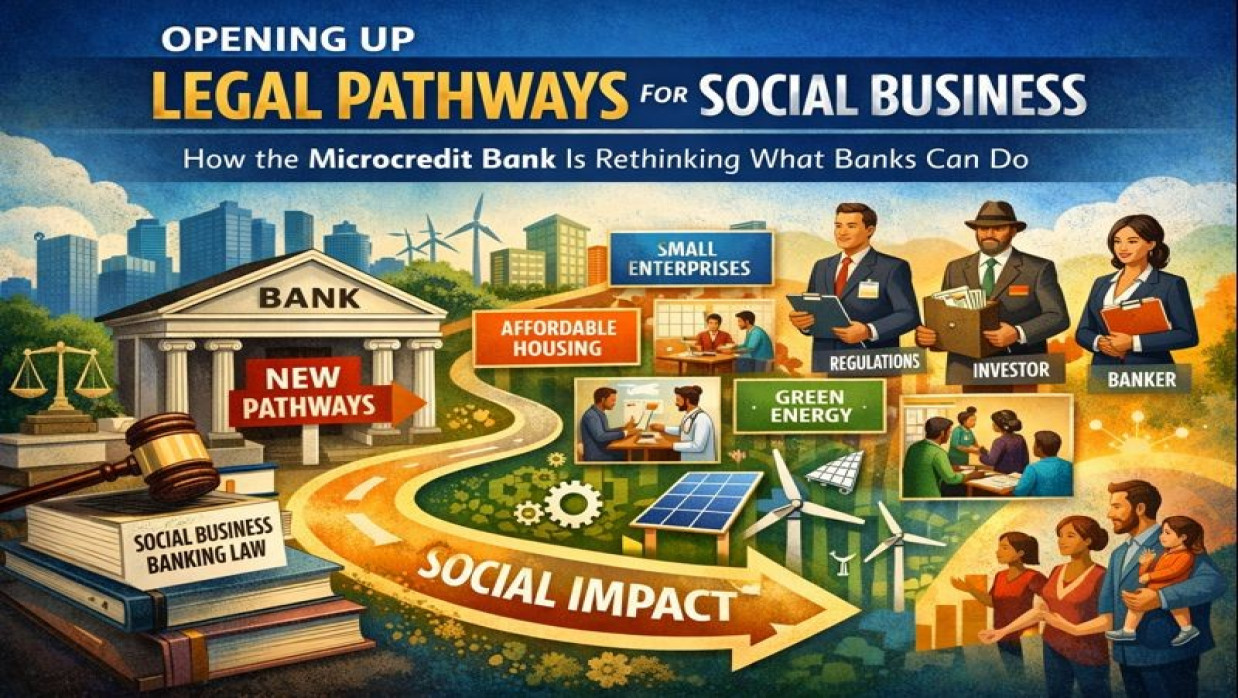

Building a Legal Framework for Social Business Banking

The Social Business Banking law aims to provide a legal framework that guides banks in pursuing their social goals without compromising their financial discipline. It’s not an attempt to rethink banking in a brand-new way. It’s an attempt to enlarge the existing rules so that banks can do more of what they’re already supposed to do. It’s a new legal framework that will guide them in pursuing their social goals. It will not be seen as charity or an exception. It will be seen as an integral part of the banking business, complete with oversight and accountability. It’s the legal recognition of the banking business that will enable the proliferation of the Social Business concept.

The Microcredit Bank Ordinance: A Defining Legal Milestone in Inclusive Finance

This is a watershed event in the legal and financial history of Bangladesh, with implications that go far beyond its borders. This groundbreaking legislation recasts the conventional notion of banking, placing social business, an enterprise model that seeks to solve social problems through reinvesting profits, on an equal footing with the conventional mandates of the banking industry, such as deposit protection, capital adequacy, and macroeconomic stability.

For the first time, a country has codified into law that banks can and should achieve social goals as part of their core mission. This is not just a symbolic move, nor a political statement dressed up in legal jargon. This is a concrete, bold, and legally binding move. This legislation grants banks, for the first time anywhere in the world, the right to employ the full range of financial instruments, not just to earn a profit, but to fight poverty, unemployment, education, health, and other social problems that plague our world.

Most importantly, this legislation establishes a transparent and accountable regulatory environment. Not only are regulatory authorities now empowered to examine how well financial institutions meet their declared social objectives, but also how well financial institutions meet their conventional regulatory requirements, such as capital adequacy ratios. This establishes clear expectations for all parties involved, including regulatory authorities, investors, financial institutions, and civil society. This is a new form of legitimacy in social finance, grounded in law rather than philanthropic goodwill.

With this legal foundation, banks can innovate with confidence. They are now free to create financial products, services, and investment portfolios that emphasize social returns over the long term without compromising financial prudence. Is it a savings product that rewards education for girls, a loan product that serves rural entrepreneurs, or investments in green energy? Whatever it is, these ideas can now shift from the fringes to the mainstream.

This is a significant departure from the traditional banking law conventions, which have limited financial institutions to business models that prioritize profit maximization above all other considerations. In doing so, the Ordinance eliminates structural barriers to innovation in social finance that have long discouraged it.

The implications of this development are significant indeed. Bangladesh, a pioneer in microfinance and other forms of grassroots financial innovation, once again sets a precedent for the world, this time in financial legal reform.

In a nutshell, the Microcredit Bank Ordinance not only reforms financial regulation but also redefines the role of finance in society. It represents a paradigm shift from a focus on profit-only thinking to a holistic, purpose-driven approach to banking, in which the financial health and progress of society and its individuals are not at odds but aligned goals.

More Than Charity: A Model Rooted in Discipline and Purpose

What sets Social Business Banking apart is also what it doesn’t do. It doesn’t offer subsidized loans, nor does it engage in politics or government-mandated lending. And it most certainly doesn’t do welfare programs through banking channels.

Instead, it is based on sound financial principles: loans must be paid back, costs must be covered, and banks must remain financially healthy. The difference lies in how the profits are used. They are not used to enrich anyone but to further increase the social impact.

In this banking model, risk assessment is not based solely on financial data. The business's social impact is also taken into account. After all, financial health depends on factors like jobs, health, and communities. This way, Social Business Banking does not fall into the same pitfalls that have weakened so many other approaches to development finance.

Sending the Right Signals: Earning Trust and Building Confidence

Making Social Business part of banking law is a powerful statement to the global finance community. For regulators, it provides a rulebook that has no gray areas or special cases. For investors, it provides confidence and credibility. And for bankers and finance experts, it provides the freedom to innovate without fear of breaking the law.

But perhaps most importantly, it provides an opportunity for major commercial banks to get involved. With the law on their side, they can create Social Business units, launch Social Business branches, or build Social Business portfolios. And Social Business Banking is no longer just a nice idea; it is a strategy that can work.

Fixing the Rules, Not Expanding Bureaucracy: A Smarter Path to Inclusive Development

At the very heart of the Microcredit Bank movement is a revolutionary yet beautifully simple concept: we don’t have to create new bureaucracies or even new institutions to achieve inclusive and sustainable development. As Nobel Laureate Dr. Muhammad Yunus has so strongly emphasized, the challenge is not a lack of infrastructure but rather outmoded laws. The solution is not more government, but a rethink of the rules that govern how existing systems operate.

Instead of going down the route of increased public expenditure or introducing more government-led initiatives, policymakers need to unlock the enormous, untapped potential of our existing financial architecture. What policymakers need to do is modernize our banking regulations, specifically the ones that impede socially oriented finance, and enable private capital, financial expertise, and entrepreneurial energy to flow into solving public problems.

In this sense, the role of the government shifts from being the sole provider of solutions to social problems to being a solution facilitator or enabler. When the laws are modernized to allow financial institutions to pursue social objectives alongside economic objectives, the entire spectrum of financial, innovative, and solution-delivery ecosystems can thrive. Capital flows into underserved communities, social enterprises grow, and socially oriented financial products are developed, all without the need to establish more government agencies or public expenditure.

In this sense, the laws are a high-leverage tool to effect systemic change because it enables the government to harness the enormous power of the market to address public problems, without compromising on either fiscal discipline or institutional efficiency.

In a nutshell, this model provides a potent new way of thinking about development: not by investing more, but by governing better. This model understands that real development is not just about resources; it’s about design. Real development is not just about resources; it’s about rules.

Redesigning Finance with Purpose: A Blueprint for the Future

The Microcredit Bank signifies much more than the establishment of a new financial entity; it signifies the proof that the underlying framework of finance can, in fact, be purposefully redesigned. This new entity defies the conventional wisdom that banking and finance should be conducted solely for profit. Instead, it signifies the purposeful reintroduction of laws, governance, and ethics into the framework of finance. By formally introducing the concept of Social Business into the framework of banking and finance, the Microcredit Bank signifies a major shift towards a new system of finance that benefits society by design, every day, not sporadically, not incidentally, and not as an afterthought.

This revolutionary new model of finance, conceived and developed in Bangladesh, resonates with the global need to redesign the underlying framework of finance. This need has become particularly critical in the context of the many pressing problems of inequality, global warming, and social exclusion that have defined the 21st century. The relevance of the Microcredit Bank extends far beyond Bangladesh's borders. This new model of finance provides a much-needed blueprint for nations seeking to redesign their economic and financial frameworks to align with society's values.

Above all, this new vision of finance has been inspired by the revolutionary ideas of the Nobel Peace Prize winner and the founding father of the microcredit movement, the illustrious Dr. Muhammad Yunus. This highly accomplished social entrepreneur has spent his life demonstrating that poverty is not created by the poor; it is created by the system that fails to serve the poor. As Dr. Yunus so powerfully reminds the world:

"We created the financial system, and we can change it. If we design it to solve human problems, it will do exactly that."

The Microcredit Bank is living proof of this vision and a testament to the power of Dr. Yunus's underlying ideas.

0 Comments

LEAVE A COMMENT

Your email address will not be published