From Microfinance to Social Transformation Based on Knowledge

Bangladesh is at an important juncture in its history today. After being lauded by the international community for its trailblazing achievements in microfinance for many decades, the time has come for Bangladesh to take microfinance's successes into the realm of an integrated, knowledge-based social business model. In fact, the formation of the Microcredit Bank, under the Microcredit Bank Ordinance 2025, cannot be viewed merely as an exercise in financial reform; rather, it can be viewed as an evolutionary step into the future by strategically integrating the realms of lived experience, public policy, and higher education under the same umbrella of development.

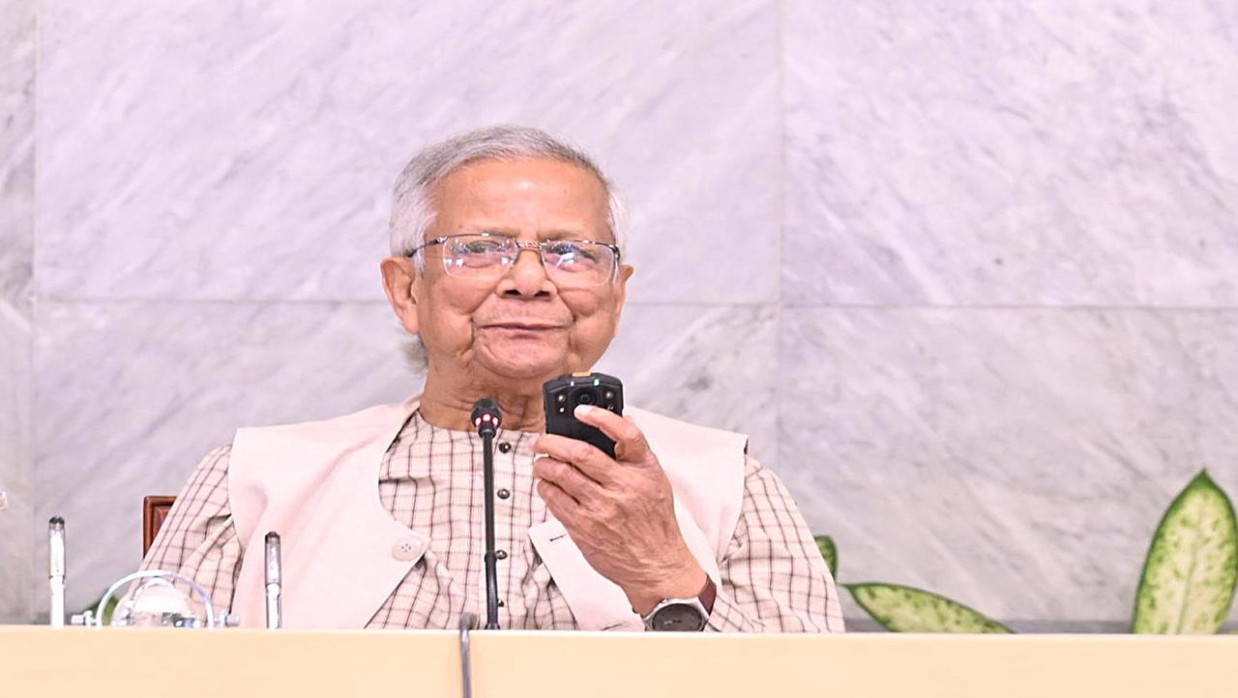

This approach will have its intellectual and academic base in the curriculum to be offered by the proposed Grameen University. Here, the wisdom gleaned from grassroots experience would be crystallized into learning, inquiry, and the development of ethical leadership. Microfinance has already proven the historic truth that the poor not only have the capacity to be creditworthy but also to be capable economic agents. Microcredit Bank takes the same idea to its logical conclusion, proving it about finance itself. Grameen University takes the idea to the ultimate conclusion by converting the experience into academic knowledge. Both institutions would be based on the philosophy propounded by Muhammad Yunus, the idea of ‘Social Business,’ in which the experience of the poor is understood not as an individual issue but as a social one. Microfinance would have proven the idea that the poor have the capacity to unlock human potential through capital.

This is then transferred to Grameen University as a basis for theory-building, innovation, and leadership with a social impact. The bank and the university, in this sense, create a living, evolving ecosystem in which finance drives education, education drives innovation, and innovation transforms society. It’s a development approach that’s naturally ethical, robust in governance, and scalable through continuous learning.

Social Business as a Formal Academic and Institutional Doctrine

What was considered a revolutionary thought process has now become a universally recognized model of development. Social Business, with its mission-driven approach, its non-distribution constraint on any dividend payments, and its reinvestment of all profits into society, has now moved from a revolutionary idea to a universally recognized mainstream. Social Business is now part of the legal underpinning of a newly formed Microcredit Bank.

The special role of Grameen University is to apply this doctrine to education by incorporating Social Business into its curriculum, research, and leadership development. The legal form of the Microcredit Bank as a Social Business model also offers students an example of how to apply this in practice: being supervised by the central bank, majority-owned by the poor, without reference to shareholder value. As a result, this institutionalization ensures that Social Business no longer relies on the presence of visionary individuals or unique circumstances. Rather, it creates a replicable model that will last through education, knowledge, and careful policy design.

Democratizing Capital: A Pedagogical Model

The Microcredit Bank’s ownership model, which allocates 60% of its shares to poor members, is considered one of the most ambitious democratic finance models worldwide. For Grameen University, this model of ownership is a living laboratory where students can learn about participatory governance, stakeholder capitalism, and democratic economics. For instance, students and scholars can learn how inclusive ownership affects lenders' and borrowers' behavior. For instance, lenders who own the organization have a sustainable agenda that affects their lending behavior.

At a more profound level, this model substantiates another central belief in Social Business learning – that poor people are not just consumers of value but also creators of it. By infusing this reality into a controlled banking system, the Microcredit Bank provides a tangible, “real-world” foundation for educational curricula on cooperative management, inclusive shareholding structures, and community-driven growth strategies. It's not just management – it's re-designing systems to achieve both economic and social equity outcomes.

From Classroom to Community: The Microcredit Bank as a Social Business Laboratory

Grameen University will focus on ‘hands-on’ learning, ‘hands-on’ research, and ‘hands-on’ problem-solving. The Microcredit Bank is an outstanding potential partner in this focus through the establishment of a ‘Social Business Laboratory’ in which students, academics, and professionals will work together in finding solutions.

Through strategic partnerships, the bank can facilitate immersive internships in areas such as social finance, rural entrepreneurship, or inclusive banking, among others. In addition, faculty-led research can be conducted in areas such as poverty, resilience, or equity in finance, as well as in rural areas or in measuring social impact, among others.

The innovation labs can focus on areas such as digital financial services, climate-resilient lending, and health-linked credit in rural areas, among others. This will ensure that there are various options to consider in creating. Furthermore, incubation programs could also provide opportunities for micro-entrepreneurs to scale up from survival-based micro-enterprises into sustainable small and medium-sized enterprises, thereby linking survival-based micro-enterprises with growth-based social enterprises. With each interaction, the feedback loop from practice back to theory is maintained, thus keeping education relevant in practice. The Microcredit Bank becomes a platform for social innovation, while Grameen University becomes a knowledge generator.

Institutional Governance as a Teaching Case

Not only does it create a legal and organizational separation that provides far more than administrative clarity, but it also serves as a potent "real-world" example of "governance in action" with direct implications for the values of ethical leadership and good organizational design so inculcated in the values promoted by the university. For those in the fields of public policy, development studies, finance, and governance in particular, it serves as a "front row seat" in the "classroom" of how laws and rules governing organizations serve as the "solution" to organizational mission and accountability problems in the absence of "soft" ethics, goodwill, and charismatic leadership.

This form of governance offers an important lesson in development work that is sometimes missed: the need to institutionalize ethical considerations rather than placing the burden on individuals. The delineation of roles between NGOs as service facilitators, the Microcredit Bank as a legal entity, and the various agencies as separate oversight bodies eliminates potential conflicts of interest, promotes transparency, and thereby encourages public trust. There are opportunities to discuss the application of the rule of law to avoid any individual having too much power, to promote the application of professional management, and to avoid the potential for mission creeping.

Through its design, future leaders realize the proper ways to scale social impact. They realize the potential for good regulation, board accountability, legal requirements, and reporting to come together to prevent mission drift while leaving room for innovation to flourish. Governance arrangements, far from stifling innovation, are designed to bring stability and legitimacy to social organizations, helping them scale, gain confidence, and endure overtime.

In this manner, Microcredit Bank far exceeds the role of a financial intermediary and becomes a "living 'teaching case'" which illustrates to all students of development organizations worldwide the manner in which development-oriented organizations might balance independence with answerability, flexibility with discipline, and innovativeness with responsibility to the public at large.

For Grameen University and other similar organizations, this model of a financial intermediary provides an invaluable tool for demonstrating to all students worldwide how ethics might inform law to create more lasting and trustworthy development solutions.

Education for Social Entrepreneurs for Systemic Change

The philosophy espoused by Grameen University is a brave and visionary one: "Social entrepreneurship is not a fringe movement or an alternative to capitalism; it is the ethical transformation of capitalism itself." In a world where inequality, environmental degradation, and social exclusion are more dominant than ever, the university imagines a new kind of entrepreneurship in which morality is hardwired into the very heart of economics.

This vision comes to life through the work of the Microcredit Bank, which invests in entrepreneurial ventures that are focused on more than just making money. These are ventures that aim to provide jobs, strengthen communities, and improve the well-being of underprivileged communities rather than chase quick profits, as conventional capitalism encourages.

At the heart of this mission is the integration of learning with practice. At Grameen University, there is a thoughtful alignment between the academic curriculum and the Microcredit Bank's mission and vision, ensuring that students don’t just study social entrepreneurship—they live it. The university nurtures a new generation of social entrepreneurs who don’t view inclusive finance from a corporate lens but from the perspective of the borrowers themselves. They learn to build enterprises rooted in the principles of Social Business, a model where profits are reinvested to tackle pressing social challenges.

Students at Grameen University are encouraged to rethink what success truly means. Instead of defining success purely by financial profit, they are guided to measure it through the lens of social impact, human dignity, empowerment, and environmental responsibility. Business, in this view, becomes a powerful tool for changing the way injustice is addressed, unlocking human potential, and restoring voice and agency to the world’s most marginalized communities.

This method produces more than just entrepreneurs; it shapes social architects, visionary leaders capable of designing and building inclusive, resilient, and just systems. With every student who embraces this mindset, a new cycle of transformation begins, one that shifts not only economic structures but also the way we think about value, leadership, and purpose. It lays the foundation for a more equitable, compassionate, and sustainable future.

Global Knowledge Leadership and Replicability

Grameen University is uniquely positioned to document, analyze, and disseminate the Microcredit Bank model, transforming Bangladesh’s lived experience into authoritative knowledge for the world. By systematically capturing institutional practices, regulatory innovations, and social outcomes, the university can convert what has been a pioneering national experiment into a globally transferable framework for inclusive finance and Social Business. Through case studies, policy briefs, academic publications, and executive education programs, this knowledge can be disseminated to policymakers, regulators, scholars, and development practitioners across regions.

The relevance of this model extends far beyond Bangladesh. Many countries, particularly in the Global South, but increasingly in developed economies as well, are actively searching for ethical alternatives to profit-driven banking systems that have often failed to address inequality, exclusion, and social vulnerability. The Microcredit Bank, grounded in Social Business law rather than charitable exception, offers a replicable institutional template: one that demonstrates how finance can pursue social objectives while remaining disciplined, regulated, and sustainable. Grameen University can serve as the convening platform where international actors learn not only what was done, but how it was legally structured, governed, and scaled.

Equally important, the statutory foundation of the Microcredit Bank creates an exceptional opportunity for long-term, longitudinal research, the kind of rigorous, evidence-based data that the global development field urgently needs but rarely possesses. Unlike short-term pilot projects or donor-funded interventions, a legally anchored social business bank enables researchers to study outcomes over time, including poverty dynamics, enterprise resilience, gender empowerment, intergenerational mobility, and institutional trust. Grameen University can lead this research agenda, setting new standards for impact evaluation and comparative analysis in development studies.

Together, the Microcredit Bank and Grameen University reposition Bangladesh in the global development narrative. The country is no longer merely a site of innovation; it has become a global knowledge leader that shapes theory, policy, and practice in Social Business. By exporting ideas, institutional designs, and educational models rather than relying on aid or isolated success stories, Bangladesh asserts a new form of leadership: one rooted in ethical finance, intellectual rigor, and replicable institutional innovation.

Conclusion: Building an Integrated Social Business Ecosystem

The combination of Microcredit Bank and Grameen University brings to life Muhammad Yunus's lifelong dream of a world in which capital serves humanity, education sparks innovation, and organizations uphold their social purposes. Social Business in Finance is what the bank does. Grameen University focuses on social business in the areas of knowledge, leadership, and innovation.

Collectively, these elements provide a complete ecosystem that goes beyond poverty reduction to the actual transformation of the system, ensuring that Social Business is more than just an idea of the moment, but an enduring and influential framework for development that is inclusive and ethical in the 21st century.

0 Comments

LEAVE A COMMENT

Your email address will not be published