May 04, 2019 by Inoka Perera

A key objective of Sri Lanka’s post-2015 foreign policy framework is to position the country as a dynamic and prosperous centre of the Indian Ocean and make the country a regional maritime and logistics hub. Located in the East-West trade route neighbouring India, Sri Lanka possesses the essential geopolitical advantage to become a key logistics hub in South Asia by establishing robust maritime networks with regional actors and greater commitments towards an enhanced infrastructure development framework.

The Indian Ocean is an emerging growth pole and one of the busiest East-West trade corridors. Over two thirds of global oil shipments and one third of bulk cargo is transported across the Indian Ocean. In fact, one-third of global bulk shipping trade, including petroleum products and coal, transits across this region. Hence, the maritime sector facilitates the economies of many countries in South Asia. Countries such as India, Sri Lanka, Pakistan and Bangladesh are major actors of maritime trade in the Indian Ocean. In 2017, India owned 53% of the regional market in container throughput followed by Sri Lanka amounting to 24% and Pakistan and Bangladesh holding 12% and 10% respectively. Located between the leading hubs of Dubai and Singapore, Sri Lanka’s strategic geo-positioning in the Indian Ocean is an impetus for its key seaports to demonstrate an escalating container throughput within South Asia.

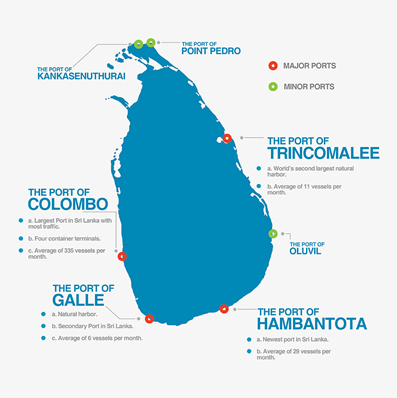

Figure 01: Sri Lanka’s Major Sea Ports

Image Credits: Sri Lankan Map, Mackinnon Mackenzie Shipping Company

Sri Lanka has four main seaports, namely; Colombo Port, Galle Port, Hambantota Port, and Trincomalee Port (Figure 01). Colombo Port among others is the largest and handled 94.84% of cargo in 2017. With three operational terminals as opposed to the single terminal operator in both Singapore and Dubai, the Colombo port has a collective installed capacity of over 7 million TEUs (Twenty-Foot Equivalent Units) in December 2018. In fact, South Asia Gateway Terminals (Pvt) Ltd. (SAGT) Chief Marketing Commercial Officer (CCO) Ted Muttiah states that they are strategising towards the 2.4 million TEU mark with additional capacity by 2019. The port is exceptionally significant as the Colombo International Container Terminals (CICT) is the only deep-water terminal in South Asia that is capable of handling the largest vessels and more shipments. Consequently, container throughput at Colombo port increased at an average rate of 9.8% between 2014-2017.

The Hambantota Port on the other hand has a strategic locational advantage than any other port in the region. It has a deep-water coastline close to Indian Ocean Shipping Lanes, capable of building large deepwater ports that can handle the world’s largest container ships and supertankers. This makes the Hambantota port an ideal transshipment point for goods and natural resources going into and out of the subcontinent. In addition, the port is integrated into the Belt and road initiative (BRI), a comprehensive infrastructural investment for Sri Lanka with avenues for wider maritime connectivity in the region. In May 02 2019, a new LPG Transshipment facility was initiated at the Hambantota Port by the LAUGFS Terminals Ltd which is also the largest of its kind in South Asia. Found amidst the key maritime trading routes connecting the East and the west, the 30,000 MT LPG Terminal is a significant investment in infrastructure development, projecting to achieve an annual export value of USD 500 million and to facilitate coastal shipping services between Hambantota and Colombo Ports for the first time in the country.

Challenges and Constraints

Although Sri Lanka appears to have a splendid geographical setting for becoming the regional hub, its efforts to fully optimize through this geopolitical significance is lacking. Competition from regional actors and lack of attention for proper infrastructure development hinders the country’s vision. The Sri Lankan port infrastructure and maritime trade are facing competition from regional ports such as Dubai, Singapore and the recently developed Sagarmala Port in India. The expanding Indian port capacities under Sagarmala will make Sri Lanka no longer a significant partner in the transshipment of goods. India’s expectations for liberalizing its shipping regulations will reduce Sri Lanka’s competitiveness as a regional hub by stagnating the country’s feeder network.

On the domestic level, the Hambantota port remains heavily underutilized while those in Trincomalee and Jaffna lack attention to proper port infrastructure development. According to Ruwan Waidyaratne, the Hambantota Port’s potency as an emerging industrial port is challenged by a demand-overcapacity mismatch. The absence of political advocacy, infrastructure compatibility in dealing with large vessels and appropriate technology to ensure smooth transactions are major factors obstructing the country’s goal towards a regional transshipment hub. Steve M. Felder, Managing Director- Maersk Line South Asia further raises the issue of insufficient capacity in the Colombo port to handle considerable cargo and transhipment volumes by 2019. Sri Lankan terminals are also unable to meet the demands of larger vessels that require deeper draught berthing facilities.

Policy Recommendations

Confronted by a number of significant challenges, it is imperative for Sri Lanka to improve its infrastructure, technology and other capabilities as limitations in operational facilities will lead to a diversion of regional cargo to competitors. With the increasing volume of mega vessels crossing the Indian Ocean and India seeking to emerge as a manufacturing hub, there is growing demand for the rapid development of the East Container Terminal. Prioritizing on free-zone and port initiatives can allow global e-commerce giants like Amazon and Alibaba to establish facilities in Sri Lanka. Integrating well-connected logistics parks, free trade zones would facilitate cargo consolidation, multi country consolidation and other ancillary services to better suit global standards. Maritime trade in the new millennium remains subjected to the waves of globalization. It is ripe for Sri Lanka to facilitate and encourage the integration of social paradigms such as digitalisation, ‘uberisation,’ and e-commerce within its maritime economy.

In addition, Sri Lanka must look towards encouraging more Foreign Direct Investments (FDI), public-private partnerships (PPPs) and consider liberalising foreign land ownership which can boost out exports and imports and local infrastructure development. Free-trade agreements (FTAs) with India, China, Pakistan and Singapore could establish Sri Lanka as a trading hub that offers preferential access to regional players. Meanwhile, Sri Lanka must strategise and formulate policies to benefit from port development projects such as Sagarmala. In fact, the Sagarmala will create an upsurge in regional container traffic which could drive down the cost per TEU handled for both shippers and shipping lines, drawing further shipping lines to the region to benefit from scale economies. Increased maritime connectivity through bilateral mechanisms such as a bilateral coastal shipping agreement with Dubai may enable expanding Sri Lanka’s feeder network and stabilize its position as a regional transhipment hub. Improving vessel traffic management solutions for effective vessel sailing and berthing arrangements are important considerations. The Ports Authorities must focus on widening Port entrances and increase harbor capacities to manure high LOA vessels. On the legal perspective, domestic regulations and policies that govern maritime cross-border trade and logistic affairs must efficiently adapt to international best practices while protecting national interests.

The potential of Sri Lanka’s locational advantage and its emergence as a major player of maritime trade is an opportune time for Sri Lanka to revitalise its vision of becoming a regional transshipment and logistics hub. However, Sri Lanka must prioritise on establishing robust maritime networks with regional actors and invest in domestic infrastructural development within its national policy framework.