by N N Tarun Chakravorty 13 December 2023

An Indian American economist and a professor at Princeton University, Avinash Dixit in his journal article titled ‘How business community institutions can help fight corruption’, suggests that initiatives from the private sector investors/firm-owners may even be more effective and prompt in combating corruption. If the investors can unite, make one single choice of not paying a bribe in any case, they can avoid the ‘prisoner’s dilemma’. Initially they might have to wait for a substantial amount of time but finally, they would be able to get things done by bureaucrats without bribes.

Kautilya, Ancient Indian polymath, in his famous book on economics and state affairs titled ‘Arthashastra’ allegorically said, ‘it is impossible to know when a fish moving in water is drinking it. In the same way, it is impossible to find out when government servants in charge of undertakings misappropriate money.‘ Then he suggested that we wean fish off water. By this, Kautilya meant that we must remove the dishonest government officials from the service. In the same vein as Kautilya, Professor Kaushik Basu, a professor at Cornell University, as against mainstream economics, says that human beings are not endlessly self-seeking. Professor Basu cites a Harvard Professor of Psychology, Marc Hauser saying that honesty, pro-social preferences and a sense of right and wrong constitute a part of the human psyche. So, only honest people must be appointed in the government service.

In 1962, Indian Prime Minister Lal Bahadur Shastri appointed an Indian politician, K. Santhanam to lead a committee on an anti-corruption move. Santhanam Committee carried out an investigation on corruption in India. After the investigation, they suggested some remedial measures. Decision-making procedures must be made much simpler and shorter to expedite economic activities. The discretionary powers of the people holding public responsibilities must be decreased to the minimum. Remunerations of the civil servants at the lower end must be increased to an amount by which they can survive without indulging in illegal practices for extra earnings; their economic and social status have to be elevated so that the young generation with honest attitudes gets attracted to these jobs. In Bangladesh one MP can spend a big amount of money according to his/her discretion, for which he/she doesn’t submit an explanation to anybody. This kind of policy promotes corruption.

Vigilance agencies and forces have to be formed of professionals and experts, and those against whom there is no question about their integrity. These agencies are to be made truly independent by law. The penal code and law-enforcement procedures have to be made stricter, and easily applicable, and punitive measures have to be made neutral and very prompt. It must be made sure that there are no divisions in prisons.

Not only the public servants but also those working in the private sector, who offer bribes must be punished and, in this regard, costs, revenues, profits and tax reports have to be made public. For example, a contractor who has got the construction contract to build a public bridge must be under a legal obligation to write every component of costs, revenue, profit in a big signboard on a daily basis. By the law of ‘Right to Information,’ any citizen of the country should be able to check the authenticity of these reports by asking for evidence and by comparing the costs with the prevailing market prices. Not only that, but any member of the public must also have the right to see his tax reports and his other sources of income, his wealth, bank balances, etc.

Business enterprises must be strictly prohibited from subscribing to political parties, and doing so, must be made a punishable crime by law. People who report unlawful activities to government departments must be protected. At the same time, reporting false allegations must be made a punishable crime as well. Public sentiment has to be built against corruption, and an environment has to be created so that members of the society look down upon the corrupt people, for which social, professional, literary groups have to be formed. Organizations, media and individuals contributing to revealing corrupt activities and forming public sentiments against corruption must be honoured nationally.

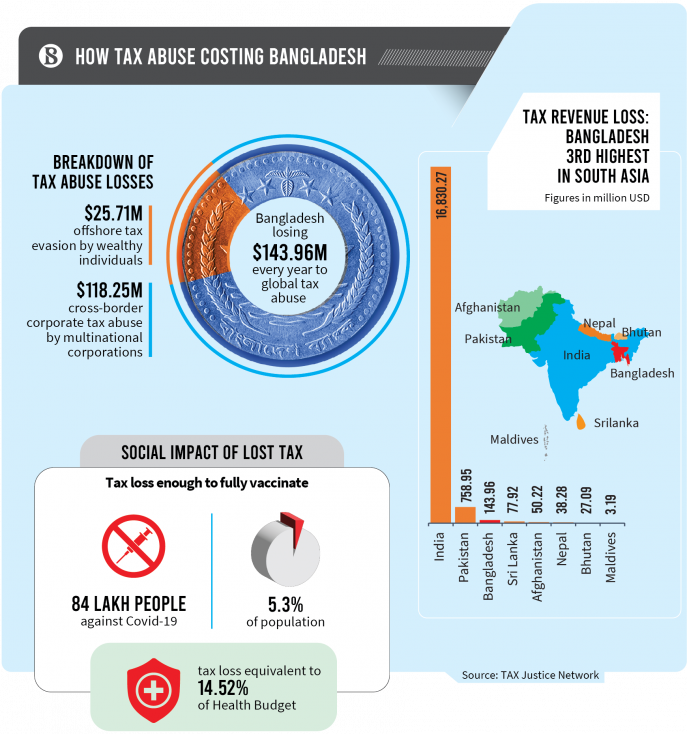

Tax evasion is a big problem in Bangladesh. Only a small fraction of the people who earn taxable incomes, pay tax and many of those who pay tax, pay a small fraction of the amount to be paid as tax. Tax evaders adopt mainly three ways: 1) Not to reveal the total income; 2) To hire a firm to manipulate incomes and show the amount to the lowest; and 3) To collude with the tax inspector. The third case involves a government official; so, the government must prevent it. To do that, the government can introduce information and supervision technology. In the particular context of tax enforcement, greater automation and computerized cross-matching systems would prevent tax inspectors from distorting information and taxpayers from evading taxes. In all cases, there must be a stricter law of high punishment for tax evaders. For the third case, there are punishments in the prevailing systems. For the second case, in any country, to the best of my knowledge, there are not any such laws meant for punishing firms helping individuals or firms manipulate tax information. Therefore, it is imperative that the government make laws proposing severe punishments for such firms, for which innovative ways have to be found.

Policy suggestions to remove this kind of corruption is firstly, to privatize and liberalize the economy and to cut the size of the bureaucracy to the minimum; secondly, to increase the opportunity costs of being corrupt by raising salaries of public officials, to bring transparency in the allocation of public resources and to make the judiciary of the state effective so that stern punishment for corrupt activities may be ensured (Khan, 2006).

It is not the duty of economists to prescribe how to remove moral degradations or social diseases. It is already said that Economists look at corruption as a bureaucratic, institutional and political problem. As a cure for it, economists rather suggest setting some tools or instruments with a view to creating checks and balances or a kind of equilibrium in the state. Democracy and accountability, presence of an effective opposition in the parliament, freedom of press and media, freedom of speech, equal opportunity to preach all religions, philosophies or ideologies, independent judiciary, independent election commission, independent human rights commission, etc., are these tools. Not only that, police and the inquiry commission must also be independent, and the recruitment procedure must be free, fair and unbiased; otherwise, corruption cannot be combatted.

The precondition for building a corruption-free state is building a corruption-free society, and building a corruption-free society is never possible if the individuals belonging to the society, are devoid of honesty, pro-social preferences and a sense of right and wrong, which, according to Marc Hauser, constitute a part of the human psyche. Then, how to prevent moral degradation or to cure social diseases, which are the symptoms of corruption? This is, as mentioned above, more of a subject of sociology and psychology. The first thing, the sociologists and psychologists suggest is a fruitful education system which impart moral education. A lot is said about moral education but what is not taught in schools is the spirit of collective life. All over the world, prevailing education systems mostly promote market economy of which competition is the main characteristic. The people who have formulated such an education system have forgotten that not competition, but cooperation is the lifeblood of civilization. There is no reason to believe that children having such education will not be corrupt and engage in the competition of making money at any cost. We, therefore, must have an education system which teaches the lesson of the spirit of collective life.

In the light of Avinash Dixit mentioned above, every individual must boycott not only the corrupt government officials but also all immoral individuals in society and businessmen in the private sector, who make money adopting illegal means. Girls must refuse to build relations with corrupt officials, immoral individuals and dishonest businessmen. She must prefer to marry a poor guy who has been putting all his efforts into the process of building a corruption-free society rather to, for example, an income tax officer. Girls’ mothers must refuse to get their daughters married to any corrupt people. Boys must refuse to marry the daughters of such people. If we could do that, there would be a possibility of building a corruption-free society someday.

References:

Basu, K., 2011. Why, for a Class of Bribes, the Act of Giving a Bribe should be Treated as Legal.

Dixit, A., 2014. How business community institutions can help fight corruption. World Bank Policy Research Working Paper, (6954).

Khan, M., 2006. Determinants of corruption in developing countries: the limits of conventional economic analysis. International handbook on the economics of corruption, pp.216-244.