New route runs into questions over China’s port footholds and Middle East war

MAILYS PENE-LASSUS

OCT. 31 , 2023 Nikkei Asia

Through a joint venture, China’s COSCO owns 40% of Italy’s cutting-edge Vado Port System, one of many investments in Europe. (Photo ©︎ Andrea Botto)

Ship-to-shore cranes tower high above choppy waters and colorful containers on the Ligurian coast of northern Italy. Sailors coming in to dock are greeted with a smorgasbord of transportation industry names and logos, from Denmark’s Maersk to Taiwan’s Evergreen. Harder to spot is COSCO, the jewel of China’s maritime business, which owns a 40% stake in the cutting-edge Vado Port System at Vado Ligure.

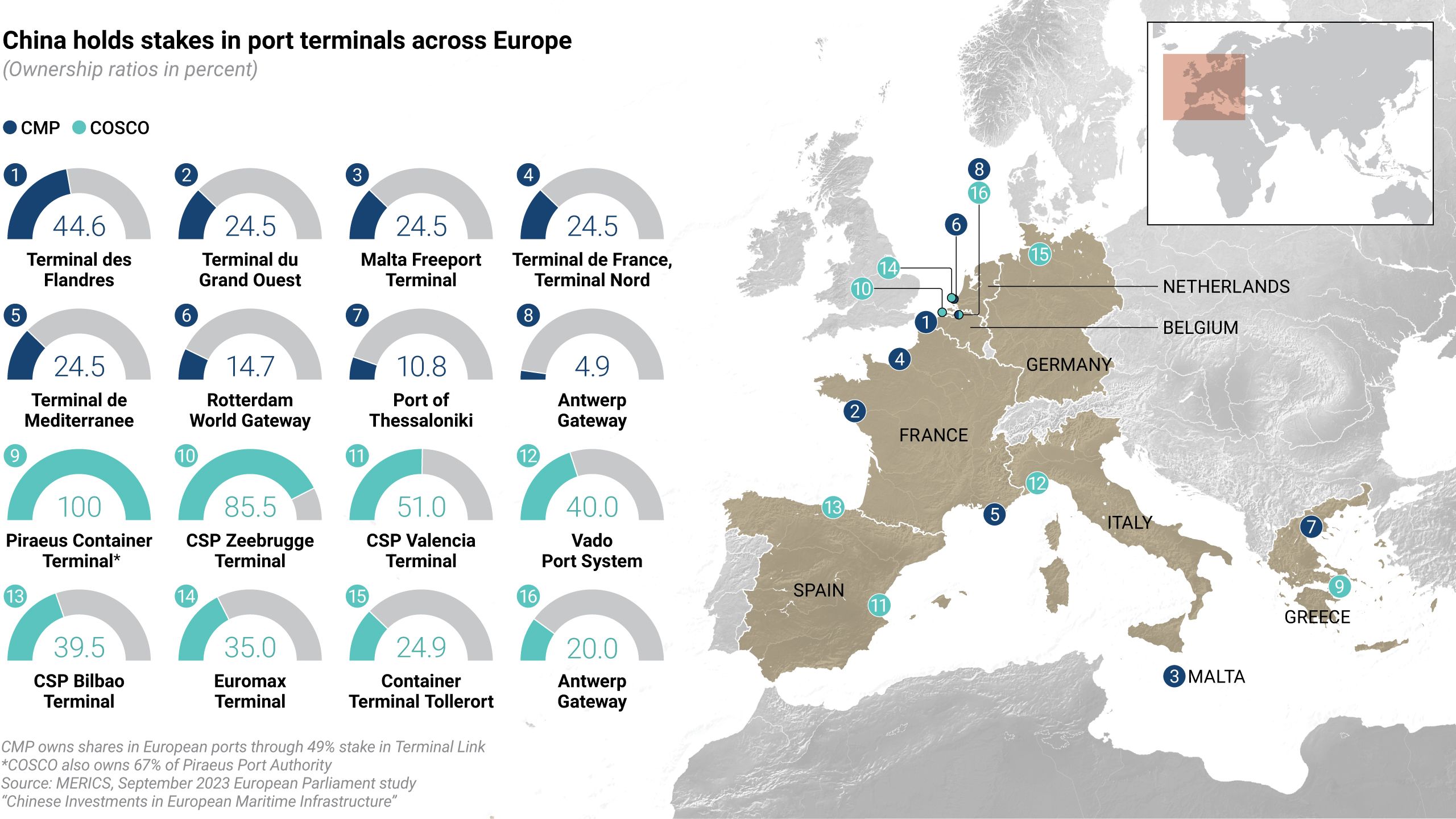

The facility is one of at least two dozen European hubs in which Chinese companies own stakes. Many of these investments dovetailed with Beijing’s Belt and Road Initiative (BRI), its drive to build infrastructure stretching from Asia to Europe and Africa, deepening its own influence along the way.

Locals say COSCO keeps a low profile around Vado Ligure, although this might just reflect its minority stake. Either way, there is growing discomfort in Italy and much of Europe regarding the BRI — over security fears as well as what some describe as economic “broken promises.” Italy, the only Group of Seven country to formally join the BRI, has signaled it wants to withdraw.

Now Europe is looking at alternatives. A week after China hosted its 10th anniversary Belt and Road Forum in Beijing in mid-October, the European Union held its own Global Gateway Forum to “boost sustainable investments in infrastructure.” As part of that goal, the EU is backing an answer to the BRI — the India-Middle East-Europe Economic Corridor (IMEC), proposed at September’s Group of 20 summit in New Delhi.

The memorandum of understanding signed by participants, including Italy, says that IMEC will have two corridors — one from India to the Arabian Gulf, and another from the Gulf to Europe. “It will include a railway that, upon completion, will provide a reliable and cost-effective cross-border ship-to-rail transit network to supplement existing maritime and road transport routes — enabling goods and services to transit to, from, and between India, the UAE, Saudi Arabia, Jordan, Israel, and Europe,” the document states.

Yet this too raises questions: how much a supposed counter to the BRI might rely on Chinese-backed ports, and how war-embroiled Israel’s position as a linchpin might complicate the plans.

China’s extensive involvement in ports poses “insufficiently understood risks” to Europe, warned a research report published by the European Parliament in September. The study — commissioned by a parliamentary committee but not necessarily representing an official stance — suggests the port investments are part of a deliberate strategy by Beijing to acquire assets it could leverage during conflict scenarios, including one over Taiwan.

The report states that Chinese companies were involved in at least 24 acquisition deals for European ports over the past two decades or so, pouring in 9.1 billion euros ($9.7 billion).

The list includes Greece’s Piraeus, where COSCO holds full ownership of container terminals as well as a majority stake in the port authority. The port is often mentioned as a potential European entrypoint for IMEC, although the corridor’s precise route remains uncertain.

More recently, in October 2022, COSCO inked a deal for nearly a quarter of Hamburg’s Container Terminal Tollerort, albeit after months of stormy debate.

Marc Julienne, head of China research at the French Institute of International Relations, explained that the Piraeus deal was made in the “gloomy context” of European debt problems.

Since then, Europe-China relations have “deteriorated sharply,” Julienne added, with “greater mistrust” amid near-constant sparring between Washington and Beijing. The G7 earlier this year resolved to “de-risk” from China, vowing to “reduce excessive dependencies in our critical supply chains.”

When investments target “a series of ports, one can wonder about the wider strategy”

Marc Julienne, head of China research,

French Institute of International Relations

A Belt and Road report by China’s State Council hailed Vado Ligure as the “first semi-automatic terminal operating in Italy.” (Photo by Mailys Pene-Lassus)

Not everyone sees Chinese port holdings as a threat.

Some European maritime industry executives Nikkei Asia spoke with, who preferred not to be named, suggested that dealing with Chinese state-linked groups like COSCO and China Merchants Port Holdings is like working with any other player.

Officials in northern Italy stress that the local port authority — which oversees Genoa and Vado Ligure from an opulent waterfront 13th-century palazzo — answers only to Rome, although some acknowledge growing caution about Chinese investments.

Kung Chan, founder of Beijing-based think tank Anbound, argued that ports’ immovability blunts any strategic value for China. “In the event of a war, these assets would be immediately seized, similar to the situation we see with Russian assets around the world today,” he said.

COSCO did not respond to requests for comment. China routinely rejects the notion that its BRI projects could pose risks. After Germany said in April that it would review COSCO’s Hamburg deal, a Chinese Foreign Ministry spokesman said Berlin should “not politicize normal business cooperation or make it an issue about ideologies and security.” Germany ultimately authorized the purchase.

A Belt and Road report issued by China’s State Council on Oct. 11, meanwhile, applauded “steadily improving” maritime connectivity, efficiency and cooperation among participating countries’ ports. It hailed Vado Ligure as the “first semi-automatic terminal operating in Italy.”

Still, many feel the situation is not black and white.

Julienne at the French Institute said that individually, these investments seem harmless. But “when it becomes a series of ports, one can wonder about the wider strategy,” he said, adding that a state does not casually “put billions on the table for an entire port.”

“Chinese investments are not necessarily a danger,” Julienne said, but to regard COSCO as a “company like any other” would be “a strong misunderstanding of the Chinese political and economic system.”

A COSCO container ship is unloaded at the port of Hamburg, Germany. (Photo by Reuters)

Olaf Merk, an expert on maritime transportation and infrastructure at the Organisation for Economic Co-operation and Development, also paints a nuanced picture.

“In terms of sovereignty, there are no direct risks,” he said. But Merk conceded that there are many factors to consider, as Chinese companies handle not only cargo but “whole clusters” — shipyards, equipment, land connections. Port cranes, for example, are mainly sourced from Chinese companies.

The European Parliament report highlights ship-to-shore cranes, specifically possible data collection capabilities, as “an important but overlooked aspect” of the Chinese presence in European maritime transport.

Such concerns echo common misgivings in the West about the nature of Chinese companies, even ostensibly private ones, and their links to the Communist Party government.

A 2019 report by the Grandview Institution, a Beijing-based think tank, said that for Chinese maritime champions to invest in overseas ports is “a necessary step for them to align with national security interests.”

Security worries are not the only reason the BRI is losing its luster in Europe.

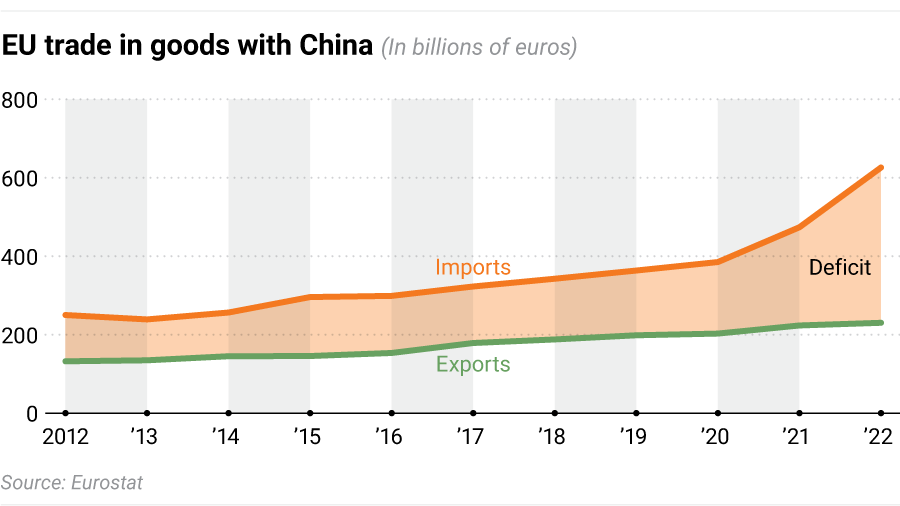

Economically, experts see the BRI as a damp squib for countries like Italy, which once viewed it as a chance for southern European states that felt forgotten by Brussels. China is the main origin of Italian maritime trade traffic, but at ports like Vado Ligure and nearby Genoa, containers that come in heavily packed head back to Asia much lighter.

Italy recorded 16.4 billion euros’ worth of exports to China in 2022, only a modest improvement from 13 billion euros in 2019, the year it joined the BRI. On the other hand, China’s exports to Italy surged to 57.5 billion euros from 31.7 billion euros during the same period.

Germany, not part of the BRI, has also seen its trade deficit with China hit the highest level in decades.

“China’s promises of massive investments, loans [on favorable conditions] and increased bilateral trade have been disappointing,” said Julienne. This “fatigue over broken promises,” as he put it, also explains why some European countries have been distancing themselves from China.

After Italian Defense Minister Guido Crosetto this year called his country’s decision to join the BRI “atrocious,” Prime Minister Giorgia Meloni is widely expected to pull out before the pact comes up for renewal in March. China in September called the collaboration “fruitful.”

The advent of IMEC is raising hopes for the economic boost that Italy and Europe have been missing.

0 Comments

LEAVE A COMMENT

Your email address will not be published