by Muhammad Kamil 7 April 2021

The International Monetary Fund (IMF) is an organization of 190 countries. The IMF’s key functions are the surveillance of the international monetary system and the monitoring of members’ economic and financial policies, the provision of Fund resources to member countries in need, and the delivery of technical assistance and financial services. Created in 1945, the IMF is governed by and accountable to the 190 countries that make up its near-global. The Fund’s mandate was updated in 2012 to include all macroeconomic and financial sector issues that bear on global stability. Pakistan has been a member of the International Monetary Fund (IMF) since 1950. Due to the unpredictable nature of the economy and heavily dependent on imports, IMF has given a loan to Pakistan on twenty-two occasions since its membership, recently in 2019. For decades, Pakistan avails funding opportunity from the world’s largest financial institution IMF (International Monetary Fund), to get rid of poverty and stabilize the economy. However, here a question arises whether IMF financial support gives positive growth to Pakistan’s economy, or is it just playing a vital role in enhancing poverty level instead of prosperity. Developing countries like Pakistan seek financial assistance to fulfill their deficits. IMF is one of the largest financial institutions that give loans to countries that need them. This article has studied the IMF role and the effects of IMF conditionsPakistan’s economy, stan particularly the Pakistan Tehreek e Insaf (PTI) government. To carry out this article, time-series data from 2018 to Dec 2020 has been taken from IFS and World Bank Database.

Role of IMF to Macro-economic Stability

Economies are trying to find and determine the factors of economic growth. Numerous factors have positive and negative relations with economic growth. Developing countries are struggling economies. They need financial assistance for progress. After World War 2, on 27 December 1945, the IMF came into existence. (About the IMF, 2018) Many people think about the IMF as an establishment that gives crisis credits to nations that have wound up in troubles, either as an outcome of poor monetary strategies or through outer conditions. Developing countries like Pakistan have always faced depraved economic situations. From the day of independence, Pakistan has felt the need for assistance. Pakistan became a member of the IMF in 1950 and approached for a loan for the first time in 1958, but the loan was canceled soon after political instability. The most recent loan taken by Pakistan is in 2019 of $6 billion. Pakistan has a long relationship of 70 years till now and has taken loans 22 times.

There are two types of debts. The first is External Debt. Any country takes loans from another country or an international organization. Such as IMF, World Bank, Asian development bank, etc., and the second is internal debt: countries borrow from private institutions in their own country. As of March 2020, the external Debt of Pakistan was around $112 billion. Pakistan owes US$11.3 billion to Paris Club, US$27 billion to multilateral donors, US$5.765 billion to International Monetary Fund, and US$12 billion to international bonds such as Eurobond. Total Debt is 82% of GDP, in which 46% is internal, and 36% is external debt. According to the IMF reports, by 2023, Pakistan’s total debt will increase up to $130 billion. The external debt of many countries, US 115%, UK 313%, and France 213% of their total GDP, is much higher than that of Pakistan. However, these are all developed countries, where the poverty rate, inflation rate, and unemployment rate are much lower than in Pakistan.

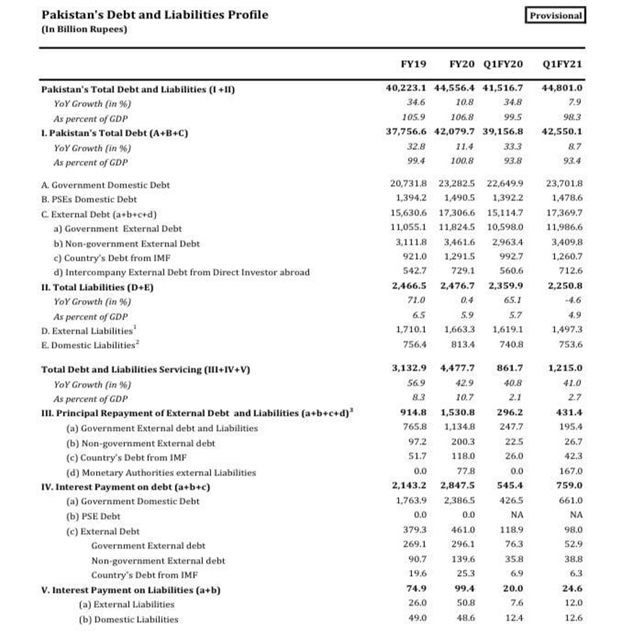

Source: State Bank of Pakistan, Pakistan debt and liabilities profile

Whenever a country goes to the IMF, the problems of the working people increase. Interestingly, during election campaigns, Pakistan Tehreek e Insaf (PTI) openly stated in many places that Pakistan would not go to the IMF at any cost. But Imran Khan (PM of Pakistan) had to break his promise and reluctantly turn to IMF. When the PTI government took over in August 2018, the current account deficit had developed to almost 6 percent of total GDP from only 1.7pc in 2016, and the Pakistani rupee had lost 15pc in incentive against the US dollar in the earlier year. The authority made sure about billions in financing from friendly nations, trusting that it would help secure a “better deal” with the IMF. That was a tremendous and expensive mistake. Pakistan and IMF announced that they had reached a preliminary agreement on a $6 billion bailout for the countries emancipated, debt-ridden economy. There is a slight difference between World Bank and IMF loans. World Bank loans are often for infrastructure development, and there are no major restrictions on obtaining them. But IMF’s loan can be compared to treating a patient. Whenever a country’s economy suffers from any disease and cannot recover, it goes to the IMF for treatment. Exports had dwindled, foreign reserves had low, and the IMF feared that Pakistan would default on payments in the future. This was not the first time with Pakistan. In the last thirty years, Pakistan has gone to the IMF 12 times and completed the IMF program only once. But eleven times, Pakistan could not fulfill the IMF program.

The following are some of the important testimonials between Pakistan and the IMF.

- Cutting expenditure or adoptive austerities measurements.

- Devaluation of the currency.

- Increased the stability of investment by supplementing foreign direct investment.

- Balancing budgets and not overspending.

- Removing price control and state subsidies.

- Privatization

According to Dr. Hafez Pasha (economist), The PTI government was too late to go to the IMF. Due to which Pakistan had to borrow under stringent conditions. Increase in taxation by up to 44 % as a result; inflation has skyrocketed.

Impacts on Pakistan Economy

Pakistan received $1.4 billion in IMF emergency financing to contain the pandemic and mitigate its economic impact. Pakistan must cut budget deficits to 0.6 % of GDP next fiscal year of 2019-2020 from the deficits of over 0.7% that the IMF expects for the year, in which Pakistan succeeded to some extent. To meet these goals, the government reportedly promised to remove Tax breaks worth about 350bn rupees (1% of GDP) in the year 2019-2020 and also raise the prices of gas and electricity, due to which inflation in the country has increased a lot. It has pledged to give the central bank, the State Bank of Pakistan, and more autonomy in its fights against inflation, which has increased sharply to over 8%. It also let market forces dictate the rupee exchange rate, which has devalued by over more than 18% against the dollar in the past years.

The extreme austerity estimates, such as heavy tax collection, rupee devaluation, and decreased government consumption taken under the IMF program, have diminished Pakistan’s current account and financial deficiency; however, at a weighty expense, lessened economic development. From July 2019 to March 2020, Pakistan’s current account deficit diminished by 73 percent to USD 2.8 billion; anyway, this was predominantly because of the enormous devaluation of the rupee, which prompted a fall in import demands and a pitiful expansion in the import/export imbalance by 31 percent. As expected, the GDP Growth rate was projected at 2.4 percent for 2020, even before COVID-19 hit the nation. In February 2020, Pakistan’s exports had demonstrated a 3.6 percent development compared to the earlier year, which pointedly declined after COVID-19. Even though the monetary shortage tumbled from 5 percent to 3.8 percent of the GDP from July 2019 to March 2020, the public authority neglected to meet the income focuses for the financial year 2020, and public debt has expanded to 88 percent of GDP. The policies are taken by the PTI government under the IMF bailout program, for example, interest rate increases, Taxation, and rupee devaluation, have likewise had a considerably negative effect on the business local area and general society. Following the IMF conditions to generate income, to decrease the fiscal deficit, the PTI government expanded duties and increased electricity and gas prices, resulting in high inflation. In January 2020, the State Bank of Pakistan expanded the interest rate to 13.25 percent to reduce the inflations; notwithstanding, this increased the expense of acquiring for investors. The large manufacturing area, particularly automobiles and textiles industries, were hit hard by expanded production costs, loan fees, and burdens, and the area declined by 5.4 percent from July 2019 to March 2020. By January 2020, inflation had expanded to 14.6 percent for the most part because of a flood in food costs squeezing poor people and laborers. As Pakistan entered the New Year, COVID-19, at last, exacerbated large numbers of the financial difficulties it was at that point confronting.

COVID-19 and Pakistan Economy

Previously confronting elevated levels of joblessness, COVID-19 further pushed the majority beneath the poverty line as millions face occupation loss fears. The manufacturing industries that were scarcely making due to high production costs and duties in the post-IMF bailout program have confronted new difficulties under COVID-19 lockdowns. Even though the drop in global oil costs may have facilitated a portion of the inflationary pressing factor, rather than offering help to the nation, the PTI government has increased the oil costs to generate income connected to past ascents in expansion. So far, the PTI government has reacted to the developing frailty among Pakistan’s population by reporting a USD 7.5 billion aids help in March 2020, which additionally incorporates a boost bundle to expand the public authority’s now existing social security net, Ehsaas, by giving financial help to helpless families under the recently dispatched Ehsaas Emergency Cash program to manage the financial effect of COVID-19.

It has been estimated that Pakistan has lost 33% of its income, and exports dropped by half because of COVID-19 flare-up and lockdown (Junaidi). Due to the COVID-19 pandemic, about one-third of farm households reported a loss of earnings (Asian Development Bank, Aug 2020). Financial experts caution of the downturn in the midst of infection lockdowns in Pakistan. Additionally, according to World Bank 2020 report on COVID-19 that Pakistan might fell into economic recession. Because of the ongoing emergency brought by the COVID-19 pandemic, it is also expected by the world bank that Pakistan’s real GDP development in FY20 is required to shrink by 1.3%. Further, if the flare-up of COVID-19 disintegrates and proceeds longer than anticipated, Pakistan’s real GDP development for FY21 may decrease by 2.2% before recuperating to 0.3% development in FY21.

Sector-wise distribution of vulnerable employment in micro-enterprises.

Source: Created by authors based on the Pakistan Employment Trends report (Sohail, 2019).

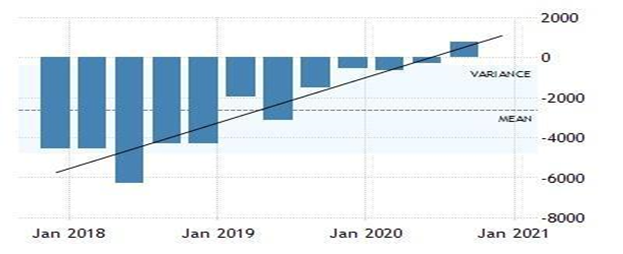

Source: Trading Economics/ Pakistan Current account

Despite all these facts, Pakistan recorded a current account surplus of USD 1.5 billion in the second from the last quarter of 2020, contrasted with a USD 1,492 million deficiency in the earlier year’s relaxing time. It was the principal current account surplus since the main quarter of 2015. The products and ventures hole limited to USD 5,797 million from USD 6,146 million every year sooner, and the optional pay excess augmented to USD 8,101 million from USD 6,078 million. Interim, the essential pay deficit rose to USD 1,526 million from USD 1,424 million. The current account surplus surpasses $5bn for the first time in history under Musharraf Regime because then funds came from foreign direct investment, and exports were good. It began to decline during the PPP era and reached the lowest level in history during the PML N government with -$6bn. There are many reasons for the current account surplus. The PTI government-imposed duties on imports so that at least a dollar goes out of the country. Expenditures were kept to a minimum, as PSDP funding was greatly reduced. This halted development and slowed down the road, and other infrastructure works as well.

| Countries | GDP Growth Rate |

| India | -10.3% |

| US | -4.3% |

| UK | -10% |

| Turkey | -5% |

| EU | -7.6% |

| Maldives | -18% |

| Afghanistan | -5% |

| Bangladesh | 3.8% |

| Pakistan | -0.4% |

Resource: IMF/ GDP growth Rate

Before COVID-19, Pakistan’s GDP growth rate was expected to be up to 2.0%. But fell to -0.4 due to covid-19. Overall, the world’s GDP growth rate has fallen sharply due to this pandemic. But Pakistan did not fall as much as the rest of the world.US, the UK, and the Maldives, where it fell to -18% as the Maldives has its entire economy on tourism. Surprisingly, despite all this, Bangladesh has grown positively. The spread of the coronavirus is a human tragedy that has affected millions of people around the world. This is harming the global economy, including Pakistan. In the current situation, the government faces a double challenge. Covid-19 is a major threat to control the spread of epidemics and reduce social and economic damage. In talks with the International Monetary Fund (IMF) to halt its financing program (central bank governor), Pakistan is adding that it would reduce COVID-19 epidemics. Still, they are optimistic about the economic outlook.

All these facts and figures indicate that IMF loans have, to some extent, but the PTI government’s economy in one direction. Some industries have maintained the Pakistani economy, including the textile industries, and the cement industry is worth mentioning. Industries in the outside world remained closed, which benefited Pakistan’s textile industry. The sale rate of the cement industry is also increasing by 15 to 20%. Besides, the State Bank of Pakistan has taken a good step in the name of Temporary Economic Reforms Facilities TERF. Under which 500 billion rupee loan will be given to automobile, textile, pharmaceutical industries.

Conclusion

It is concluded that Pakistan is facing multifarious economic problems and can be resolved through good governance, proper utilization of resources, self-reliance, increasing export base, overcoming energy crises, and maintaining law and order situations. IMF temporarily stabilize Pakistan’s economy. Pakistan needs structural reforms for a permanent, stable economy. Pakistan’s future financial prospects look encouraging; however, the actual understanding will rely upon various basic factors, for example, the benign global economy, Pakistan’s effective integration into the global economy, stable monetary approaches, and a solid institutional and administrative structure, Investment in Human Resources and also political stability. There are a lot of bumbles in Pakistan’s economy. Pakistan needs to invest in agriculture and industrial area. The profitability of the individuals worth referencing that Pakistan ought to put resources into the human resources. It ought to build up IT sector which gives high business and increments the norm of the individuals. It ought to build up a passage framework that stops lawmakers from pulling out cash from the economy and defiling.