by Engineer Zahibudin Makhkash 1 September 2018

According to the Department of Defense’s (DOD) Task Force for Business and Stability Operations (TFBSO), the estimated value of Afghanistan’s minerals and hydrocarbons deposits collectively known as “extractives” is more than $1 trillion, with $908 billion in mineral resources and more than $200 billion in hydrocarbon deposits. Recognizing the potential economic importance of these resources to Afghanistan, the United States, through TFBSO and the U.S. Agency for International Development (USAID), has obligated nearly $488 million to support the Afghan Ministry of Mines and Petroleum (MoMP) and develop Afghanistan’s mineral and energy resources. Afghanistan’s mountainous environment is home to a variety of geological formations with an abundance of minerals, precious metals, gemstones, and hydrocarbons, estimated by TFBSO to be worth over $1 trillion. The U.S. Geological Survey (USGS) has identified potentially significant mineral deposits in nearly every province of Afghanistan, with some larger deposits spanning multiple provinces. The Afghan government awarded the largest-scale mineral contract to date, for the Mes Aynak copper deposit in Logar province, to the Metallurgical Corporation of China (MCC) in 2008. The government completed Afghanistan’s first railway with an investment of $170 million in 2010. The 76-kilometer (km) route link Mazar-i-Sharif to the extensive rail networks in Uzbekistan. The new route would allow Afghan exporters to transport minerals and other goods into Europe. China Metallurgical Group Corporation (MCC) is building a railroad to transport copper ore in Afghanistan from Logar to Kabul.

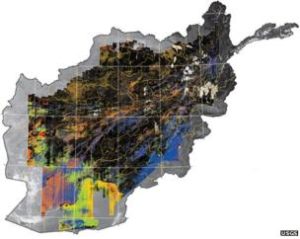

Map of Afghanistan’s surface Minerals

Proven oil and gas reserves, on the other hand, are concentrated in the north of the country near the Turkmen and Uzbek borders. Existing infrastructure for the production and transportation of oil and natural gas is largely centered in Balkh, Jowzjan, and Sar-e Pol provinces.

Afghanistan has an abundance and wide range of natural resources. In the north and south, for example, there are several potential hydrocarbon sites. Ferrous and nonferrous metals and strategic minerals may give Afghanistan a particular advantage in attracting international investment. Gold, platinum, silver, copper, iron, chromites, tantalum, lithium, uranium, and aluminum have serious potential for economic exploitation. The country also has massive deposits of dimension stone, including rare white, orange, and green onyx and more than sixty other varieties, as well as a rare blue stone called Afghanite, which was discovered in 1968 in Badakhshan by German geologists. Afghanistan’s emeralds, rubies, tourmaline, aquamarine, amethyst, some types of sapphires, turquoise, and lapis lazuli have long charmed gemstone markets and dealers alike. Overall, the value of the country’s underground resources has been roughly estimated at as much as $1 trillion, but their true extent is unknown because they remain largely unexplored.

However, Afghanistan may be taking a dangerous path in tendering its mining sector to private investors. There is a substantial risk that the country may become yet another example of the resource curse that affects so many and especially low-income countries with sizable endowments of depletable natural resources.1 Of more than three hundred mining and hydrocarbon contracts, a great number may have been exploited by local strongmen under the protection of warlords or awarded through political influence in exchange for cash, election favors, or various other kinds of support.

Afghanistan has large untapped energy and mineral resources, which have great potential to contribute to the country’s economic development and growth. The major mineral resources include chromium, copper, gold, iron ore, lead, and zinc, lithium, marble, precious and semiprecious stones, sulfur and talc among many other minerals. The energy resources consist of natural gas and petroleum. The government was working to introduce new mineral and hydrocarbon laws that would meet international standards of governance. The United States Geological Survey (USGS) and the British geological survey were doing resource estimation work in the country. Prior to that work, Afghanistan’s exploration activity had been conducted by geologists from the Soviet Union who left good-quality geologic records that indicate significant mineral potential. Resource development would require improvements in the infrastructure and security in Afghanistan. Afghanistan’s mining industry was at a primitive artisanal stage of development; the operations were all low scale and output was supplied to local and regional markets. The government considered the development of the country’s mineral resources to be a priority for economic growth, including the development of the industrial mineral resources (such as gravel, sand, and limestone for cement) for use by the domestic construction industry. Investment in infrastructure and transportation projects for mining was a critical aspect of developing the mining industry.

There are five mines which are in Ghori Cement (cement, coal, and cement raw materials), Nuraba and Samti (gold), Qara Zaghan (gold), Kohi Safi (chromite), and Western Garmak (coal). These resources can be extracted without very large capital and highly advanced technological inputs, which would require involvement by international mining companies. The operations are at different stages in their life cycles, and contracts were awarded at various times between

2007 and 2012. The five mines were selected to provide some variation in geographic location,

Minerals being extracted, timing within the period, and companies involved and their political

Connections and networks. The Tajik-Afghan crude oil zone was discovered in 1958 with a reserve of around 946 million barrels of crude oil and 8 trillion cubic feet of natural gas. The worth of Afghan-Tajik oil and gas zone is estimated at $123 billion. The sedimentary Afghan-Tajik oil and gas zone is divided into 12 blocks.

Despite Afghanistan’s vast array of mineral reserves, the majority of mining operations today are artisanal or small scale, and not under the control of the Afghan government. Moreover, the unregulated and illegal excavation and trafficking of precious stones and other minerals have played a role in the fundraising strategies for militant groups and organized crime syndicates throughout the past 4 decades of conflict in Afghanistan. Additionally, Afghanistan’s hydrocarbon sector is even less developed because technological and capital constraints tend to preclude exploitation by small firms.