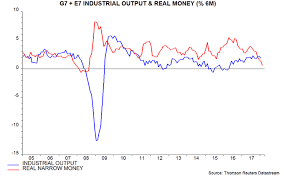

The impressive retraction in the US Equity Markets since the 24th of December, 2018; (the day that the severe sell-off in US Equities was finally halted) has been awe inspiring, especially as it was artificially generated in an attempt to support an illusion of economic prosperity within the context of the present Global Recessionary Environment. You could almost think of it as the day Grinch mugged Santa and stole the Christmas Rally and subsequent year-end bonus and dividend payouts.

To understand the mechanics of how it was done, you first need to look at the WTI and JNK charts. West Texas International or WTI, is basically another name for the price of US Oil, (Brent being the price for International Oil — which is more along the lines of OPEC and the prop that supports the Petro-Dollar).

JNK is the index for Junk Bonds. They are termed Junk because they are bonds which are rated at BBB, B or even B-, (meaning that these are highly risky loans given to Corporations that are struggling or may even go bankrupt but still need finance). Most Shale Oil Companies in the US are startups and they acquire funding on the High Risk “Junk” Bond Market. For these companies to be profitable they need a high price fix on the WTI index, which in turn releases capital from the Junk Bond Funds, which then again; in turn, drive up the JNK Index. It is during this final phase of the operation that the CTA (Commodity Trading Adviser) Algorithms; which is another name for Hedge Fund Machines; pick up the JNK Value Figures and correspondingly buy US Equities in order to ramp up the relevant Stock Index Values.

The actual mechanism is very simple.

You place orders on the WTI Futures Markets which you in turn NEVER fulfil (spoofing). These Futures then drive up the price of WTI; Shale Companies then ask for loans at the B- Rated Fund Providers. Bonds are bought and the JNK Index moves higher and you are then left to just hang back and watch as the CTA Machines match the corresponding rising JNK Index by ramping up the S&P500.

This will not last very long and it will also not end well, because of the simple reason that you are artificially raising the price of an oversupplied commodity (Oil) within an impending Global Recession in order to indirectly manipulate the price of your target Index. (Manipulating a Secondary Market (JNK and WTI) to influence a Primary Market, (S&P500, Dow30)).

The present US Administration uses this Primary Index, (the US Stock Markets), as a Report Card to showcase the (illusionary) positive effects that their policies are having on the US Economy, in order to appeal to US Workers in selling them a dream. However, as Equity Markets are being ramped up artificially to All Time Highs, a case is being made for Future Inflation, and if, the US Federal Reserve even hints at raising Interest Rates in order to cool down a (supposedly) super-charged economy, the Indexes will crash.

The reason why? Higher Interest Rates make borrowing money for buy-backs more expensive for US Corporations. (US Corporations buying back THEIR own stocks is THE ONLY THING driving up their Index Values, rather than borrowing money to invest in new plants, new machinery, or skills development for the health, well-being and knowledge acquisition of their workers so as to increase productivity). Investors sensing that their stocks might not ramp up any higher then sell and hoard cash and buy US Treasury Bonds; (which in simple terms means investing in the US Government rather than in US Corporations), and correspondingly, the Equity Market falls.

This is the current desperate measure being played out since that fateful day of the 24th of December, 2018. But, unfortunately, it has hit a wall. WTI can only reach a certain figure beyond which it will be impossible to move any higher, firstly due to the theory of supply and demand; and secondly, the fact that over-priced Oil will adversely affect the economies of China and India, (currently the two major sources of cheap labour and finished materials for US and European consumers and industries; wherein both countries rely on 80% of their oil needs having to be imported). Higher Oil Prices are also a trigger that can generate Inflation.

JNK has also hit a wall and the S&P and Dow are struggling to breach All Time Highs. These deceptive manipulations to artificially inflate US Stocks have now become very obvious and is setting up a scenario for a sudden and catastrophic drop in US Equities that may well test and perhaps even surpass the lows of December 2018.

The current formula in simpler words is this — Buy Oil Futures, because it will drive Junk Bonds higher, and the Stock Market will follow. However NONE of these WTI Futures Options Contracts will ever be intentionally fulfilled. They are being left to expire as un-filled orders.

The US Dollar Index however is not buying this. The USDX should weaken, instead it is rising and this is in turn hurting the Stocks and Currencies of Emerging Economies, (think Turkey with regard to their currency and India; with being the world’s 8th largest economy; as prime examples).

The Turkish Central Bank is desperately burning up their US Dollar Reserves in an attempt to prevent the Lira from drastically devaluing and the Indian Stock Markets keep falling as the Dollar gets stronger and the Indian Central Bank or the Reserve Bank of India, is forced to keep “buying the dip” to support the Exchange. The RBI has been forced to initiate currency swap arrangements with the Bank of Japan and the Central Bank of the UAE so as to be able to borrow money on very short term lending agreements; which are then declared as Foreign Exchange Reserves during overnight reporting times and are then lent on to Indian Corporations and Banks via Mutual Funds to temporarily buy back their own stocks. (As of the 13th of May, 2019, the Sensitive Index or Sensex; has lost 4% of its value and has been falling since the 3rd of May over the subsequent 9 trading sessions).

This is Direct RBI Intervention in the Stock Market, (whose role is to regulate rather than influence); and this to, after the RBI has dropped Interest Rates twice within the past 4 months in an effort to support the incumbent in his re-election bid.

An imminent violently destructive CTA generated correction in US Equities will have a detrimental effect on the Indian Exchanges, at a time critical for the outcome of the largest election in the world, which is also the most important election for European and US Corporatism THIS Century; (as the vast resources and labour capital of India remain the final frontier to fully and comprehensively; re-exploit).

70 plus years after the traumatic loss of business incurred by the City of London following the events post 1945; leading on from the Defeat of Fascism by the combined efforts of the Heroic Red Army and the 4 million SubContinental Volunteer Soldiers of the Colonial Imperial British 8th and 14th Army; whereby European Corporations found themselves reluctantly needing to have to give up their hold over the “Jewel in the Crown”, now is the best opportunity for them to re-colonise India under a compliant BJP led Government.

Corporations find it economically efficient to conduct transactions with autocratic Governments which rule with little to no transparency or accountability to their electorates, (a “One-Stop Shop”). Infact; elections and the will of the people are an irritating theatre that must be adhered to within the spirit of the greater good; and provide an illusion that the people’s aspirations are being met.

Bread and Circuses for the people; Hand-Outs instead of a Hand-Up, allow the electorate to certify the mandate of the MultiNational Corporations’ choice; then present that as the will of the people and initiate the process of selling the nation “by the (Great British) Pound”.

The survival of the City of London, Wall Street and Frankfurt; depends exclusively on the outcome of the 2019 Indian General Election. A result that will be “swayed in the right direction” at any cost, towards the current incumbent.

The economic model of Europe, prior to 1939, was based on Colonial Expropriation; where Asia and Africa provided the raw materials, resources and labour at near zero cost; which were then fabricated into final finished goods within European Factories, and then subsequently sold back into the pliant and captured Colonial Markets at a huge markup.

This extremely efficient economic model allowed for a dramatic improvement in the social conditions of European Workers, whose clamouring for self determination for their own economic welfare was conveniently paid-off and subsidised by the un-paid efforts of their fellow Colonial Workers. It also marked the exact time that Karl Marx laid out his clear and precise scientific Economic Theory.

The advent of direct British Rule in India (by which I mean the territory from Peshawar to Dhaka and all points in between which constituted the Crown’s direct realm and not the territory that represents the current Republic of India), corresponds exactly to the time when Marx presented himself to Europe. His Thesis however did not gain much traction amongst English Workers because the Colonies provided the roaring fuel that sustained the Industrial Revolution with unlimited free raw material and resources, which contributed to a dramatic improvement in living conditions for those very same English Workers.

Corporations are now in a crisis for their own survival and a favourable outcome in the 2019 Indian Republic’s Election, (engineered towards the “business-friendly” incumbent during a possible Stock Market MeltDown), is the only way forward for them to be able to save themselves from a broad and deep social upheaval that will undermine their Global Influence, (if it is not immediately contained).

“It’s Show Time”, as Michael Keaton famously said in the movie; Beetlejuice.