Summary

India recognised the importance of rare earth back in 1950 and started extracting rare minerals through the establishment of the Indian Rare Earth Limited. India could not, however, make progress in this sector due to several reasons. Against this background, this article investigates some of the major steps undertaken by India to develop the production of this sector. This piece also tries to identify why India failed in developing rare earth production.

Introduction

Rare earth metal collectively comprises a relatively limited group of 17 elements, including the 15 lanthanide elements on the periodic table, and two other related elements, scandium, and yttrium. Rare earth is typically divided into two categories according to the separation process: light rare earth and heavy rare earth. The unique physical and chemical properties of these elements have made them an integral part of our modern life. The metals are essential ingredients in all kinds of high-tech goods, including smartphones, laptops, hybrid cars, wind turbines, and solar cells, among other things. There are important defense applications as well, such as jet fighter engines, missile guidance systems, antimissile defense, space-based satellites and communication systems. A lot of defense equipment cannot be manufactured without this scant mineral.

The debate revolving this metal started with the speculation in the market that China may consider cutting the export of rare earth to the US, as a weapon in its ongoing trade war rattled the market world over. The MV Index Solutions (MVIS) Global Rare Earth/ Strategic Minerals Index, which tracks the shares of 20 producers from 10 countries, including China, Australia, and Canada, jumped 6.4 percent the next day[ii]. Value of the shares of companies making magnetic materials skyrocketed. The Union Bank of Switzerland (UBS) reported that prices for neodymium and praseodymium, the two main rare piles of earth used in magnets, have risen from about US$32 (S$43) per kilogram to about US$42 (S$57) per kg[iii]. All these incidences took place because China develops its capacity to produce rare earth materials and subsequently control 90 percent of the world production with only 36 percent of the reservoir. Other countries like India also tried to develop their capacity and started extracting rare earth long ago in 1950 but failed to make any mark in the global market. It is worthy to note that India started extracting rare earth before even China[iv].

Against this background, this paper attempts to understand why India failed in developing rare earth production. It also scrutinises the major efforts that were undertaken to develop the capacity of the industry. Besides, the article will investigate the global scenario of this scarce metal industry.

The global picture

Examining the available data, it is found that China consumes around 104,000 metric tons (MT) of rare earth, which is 67 per cent of the total consumption worldwide. China is followed by Japan, the US, and the EU with 16 per cent, 13 per cent and four per cent respectively.

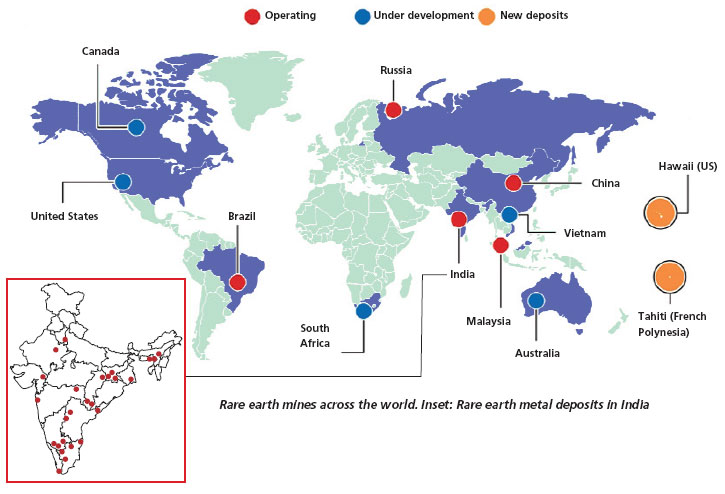

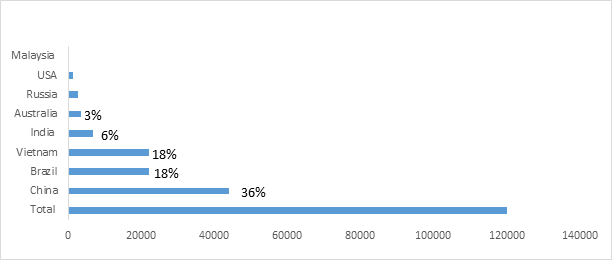

Data further suggest China controls about 90 percent of global production of rare earth metal while it possesses only 36 percent of the global reserve of this rare metal[v]. It is because other countries with rare earth mineral reserves do not extract the mineral due to so many reasons. During 2018, China produced 120,000 MT of rare earth oxide which is higher than its reserves. China produced this higher volume by importing rare earth from countries like Canada, the US, and others. During 2018, Australia, the US, Russia, and India produced rare earth metals of 20,000, 15,000, 2600, and 1800 MT respectively[vi]. The data in figure 1 shows the volume and share of the selected countries in the total reserves of rare earth in the world.

UN COMTRADE data[vii] reveals that China exported rare earth worth US$3 billion (S$4 billion) while it imported US$172 million (S$234 million) in 2017. The US imported US$109 million (S$148 million), while it exported US$14 million (S$19 million) of rare earth in 2017. India imported US$9 million (S$12 million) and exported US$16 million (S$22 million) worth of rare earth metals in 2017.

Figure 1: Major reservoirs of the rare earth (1000 MT REO)

Source: Statista, 2019

It is this production capacity built over the years that grants China huge leverage to manipulate the global price and its export. As mentioned earlier, apart from China, its neighboring country India, with a total reserve of 6 per cent of the world, made several efforts to develop its capacity to produce rare-earth. However, its efforts were not successful. In the next section, we will investigate some of the vital steps undertaken by India and the current scenarios of this strategic industry.

India’s Rare Earths Industry

India is one of the early countries to recognise the importance of rare earth. The Indian effort in developing its indigenous capacity to produce rare earth metal started immediately after its independence. India established the Indian Rare Earths Ltd (IREL) in 1950. In 1963, IREL was nationalised and its operations were handed over to the Department of Atomic Energy (DAE) of India. Since then, it is working as a central public sector unit. Despite having an early mover’s advantage, India could not capitalise on its strength, and its production volume kept on falling.[viii]) Though the IREL was set up to develop India’s capacity to produce rare earth subsequently, its focus shifted to other common minerals, (which are comparatively easier to extract) as evident from the fact that the majority of its income is generated from the production and marketing of the other common minerals that are contained in the beach sands such as ilmenite, rutile, sillimanite, and zircon. [ix])

India’s urge to develop its rare earth industry gained momentum again in 2011-12 when Japanese firm Toyota Tsusho, along with the IREL, set up a joint venture called Toyotsu Rare Earths India in Andhra Pradesh to make rare earth such as neodymium, lanthanum and cerium. But due to India’s delay in resolving policy hurdles, related to environmental [x] clearance and in issuing the licence[xi] in extracting the mines, the production from this sector may not reach its expected volume. On another occasion, later in 2014, it was reported that Indian Prime Minister Narendra Modi and Japanese Prime Minister Shinzo Abe will sign a deal to produce rare earth metals in India and export it to Japan. It was reported that about 2000 to 2300 tons or roughly 15 per cent of Japanese demand will be fulfilled from this plant[xii]. However, no information is available about the implementation of the project in the public domain. It is to be noted that Japan initiated all these processes to reduce its dependence on Chinese exports for its rare earth consumption. Japan started diversifying its source of rare earth import after China suddenly stopped exporting to Japan after a territorial dispute in 2010. India and Japan also proposed to explore third country markets like Afghanistan and Kazakhstan to secure their supply sources[xiii]. Considering India’s deep political and diplomatic association with Afghanistan, it is expected that India can take the benefit of its relationship in this regard.

Looking at the current situation, it seems that all these efforts remained on paper only and could not be realised. Several factors are blamed for the freezing or delay in these projects and the overall failure of the Indian rare earth industry to achieve its intended outcomes. Some of the primary reasons that led to failure are summarised in the next section.

Why did India fail?

Despite being an early mover, India could not develop itself as a manufacturer of rare earth metals even with the fifth largest reservoir in the world. Although India set up an exclusive firm to extract rare earth, it did not devise a separate guiding policy to expand the production of rare earth[xiv]. Answering a parliamentary question in 2015, an Indian Prime Minister confirmed that India had not undertaken any significant step to move ahead in the production value chain of rare earth metals[xv]. The Indian rare earth industry keeps on operating on the downstream production process only. The upstream process involves higher environmental risk and advances technology. Production volume could never reach to the installed capacities of the production facility[xvi].. Further, with the fluctuating production volume, it could not present itself as an alternative source to any of the major consumer.

In 2016, a study, supported by the Indian government’s Department of Science and Technology (DST), provides a framework for India to assess the impact of critical minerals including rare earth in the manufacturing sector, considering both economic importance and associated supply risks[xvii]. The study argues the development of this mineral will also give a fillip to India’s ambitious Make in India plan by enhancing the volume of rare earth production. But no document claiming the launch of the project is available in the public domain so far.

Another reason for the unsuccessful rare earth industry in India is linked with its failure to promote entrepreneurship in this sector. Only a few private players like Cochin Minerals and Rutile Ltd (CMRL), Beach Minerals Co. Pvt. Ltd, V.B. Minerals and Resins Pvt. Ltd etc. are operating in this sector. Foreign investors have always kept a distance from this sector. This is mainly because the sector was reserved for the public sector. Apart from Toyota, there hardly exists any other foreign player in this sector as of now.

Due to the small domestic demand, entrepreneurs may not have been interested in investing in this sector. Although industries like mobile phones, electronic goods, and vehicles are manufactured in sizable quantities in India, they rely largely on China as the same rare earth can be procured from China at a much lower price. It is due to the cheaper price offered by China, India deferred its plan to invest in the infrastructure related to rare earth extraction in 2004[xviii]. It is to be noted that, due to the low cost Chinese supply of rare earth, once the self-reliant US has also become completely dependent on China.

Conclusion

Regular and cheaper supply of quality rare earth

metals from China has reduced the incentive for countries to invest in this

sector. After China’s rise as a major supplier of the metal, countries like the

US and Australia subsequently dropped their production. It is also largely

because rare earth mining and processing is environmentally risky, creating

toxic and even radioactive wastes that many countries have tended to avoid or

abandon its production. But, as evident from the above discussion, due to the

dominance of China in the production of the rare earth metal, countries have

realised the need to be self-reliant. India, which aspires to be a

manufacturing hub, should also explore options to expand domestic production in

its national interest. There is a need to evolve a mechanism where a larger

private industry partnership is welcomed, and international partners identified

for technological collaboration. India should invest in a research and

development program for the development of environment-friendly and sustainable

methods to extract the mineral. If India remains in the same position, it will

lose another chance to be self-reliant. This will further affect the production

volume of the industry that uses rare earth as their intermediate goods. The import of the mineral will keep on

hampering India’s trade balance. Adopting environment-friendly modern

technology can help to increase production and eventually reduce the cost of

production through the economics of scale.

[ii] Straits times (23 May 2019) Shares jump as Xi visits rare earth firm, sparking speculation. Straits times. Singapore. Accessed on 30/06/2019. Available at: https://www.straitstimes.com/asia/east-asia/shares-jump-as-xi-visits-rare-earth-firm-sparking-speculation

[iii] Lucy Hornby and Henry Sanderson (4 June 2019) Rare earths: Beijing threatens a new front in the trade war. Financial Times, London. Accessed on 30/06/2019. Available at: https://www.ft.com/content/3cd18372-85e0-11e9-a028-86cea8523dc2

[iv] See Statista.com

[v] As per the data available at Statista.com

[vi] Statista.com, 2019

[vii] Considered HS subheading 280530 and 284690 in calculation.

[viii] S Chandrashekar and Lalitha Sundaresan, ‘India’s rare earths Industry: A case missed opportunities. Economic and Political weekly, Vol-L1, No-3. (16 January 2016), pp. 27-33.

[ix] IREL (2018) Annual Reports, 2016-2017. IREL, New Delhi.

[x] Ishan Kukreti (16 April 2019) Environment ministry stops clearance to mining of beach sand minerals. Down to Earth. Available at : https://www.downtoearth.org.in/news/mining/environment-ministry-stops-clearance-to-mining-of-beach-sand-minerals-63999 Accessed on 05/06/2019

[xi] KVL Akshay (19 October 2016) India not realising potential of rare earth industry. The Economic Times. New Delhi. Available at: https://economictimes.indiatimes.com/industry/indl-goods/svs/metals-mining/india-not-realising-potential-of-rare-earth-industry/articleshow/54940321.cms Accessed 7/6/19

[xii] Satoshi Iwaki (28 August 2014) Japan to Import rare earth from India. Nikkei Asian Review, Tokyo, Japan

[xiii] Ajay Lele (2012) India Japan joins Hands to challenge China’s rare earth. IDSA comment. IDSA, New Delhi

[xiv] See Ministry of Mines, Government of India.

[xv] Parliament question no 1601, 2015. Rajya Sabha. India.

[xvi] Annual Reports 2016-17. IREL.

[xvii] PTI (19 July 2016) Rare earths to play crucial role in ‘Make in India’s success. The Economic Times. New Delhi. Available at : https://economictimes.indiatimes.com/industry/indl-goods/svs/metals-mining/rare-earths-to-play-crucial-role-in-make-in-indias-success/articleshow/53285011.cms Accessed on 02/07/2019

[xviii] Lele and Bhardwaj,(2014) Strategic Materials: A resource challenge for India. IDSA, Delhi.

Well Analysed. Recent updates are - Many Private Players (India) are independently evaluating the Sector, and willing to tie up with either the Top Category of Rare Earth Magnet Manufacturers like Hitachi Metals, TDK, Shin Etsu, VAC, San Huan etc., or with the Chinese Manufacturers of RE Magnets, who are willing to penetrate in the Indian Market considering the RE Magnet demand potential from Segments like - EV Motors (specially for 2 Wheelers and 3 Wheelers, 4 Wheelers will take another 5-6 years to scale up), Solar Pump, Wind Turbine Synchronous Generators, BLDC Motors for Electrical Appliances, Mobile Phones etc. Once these tie-ups are successful, and domestic RE Magnet manufacturing becomes a reality, the Upstream of Rare Earth Mining, Refining and RE Oxide Production will automatically become streamlined and necessary Regulations will come to boost this segment. The Private Entities have also come up in the Mining domain, and soon the Raw material challenge will be resolved. Indian downstream RE Manufacturers will have a level playing field with the Chinese players under that scenario (5-6 years from now), and soon it will become the Global choice for sourcing, as the World is anyway looking for alternate sources of RE Materials, to come out of the Chinese supply chain dominance.