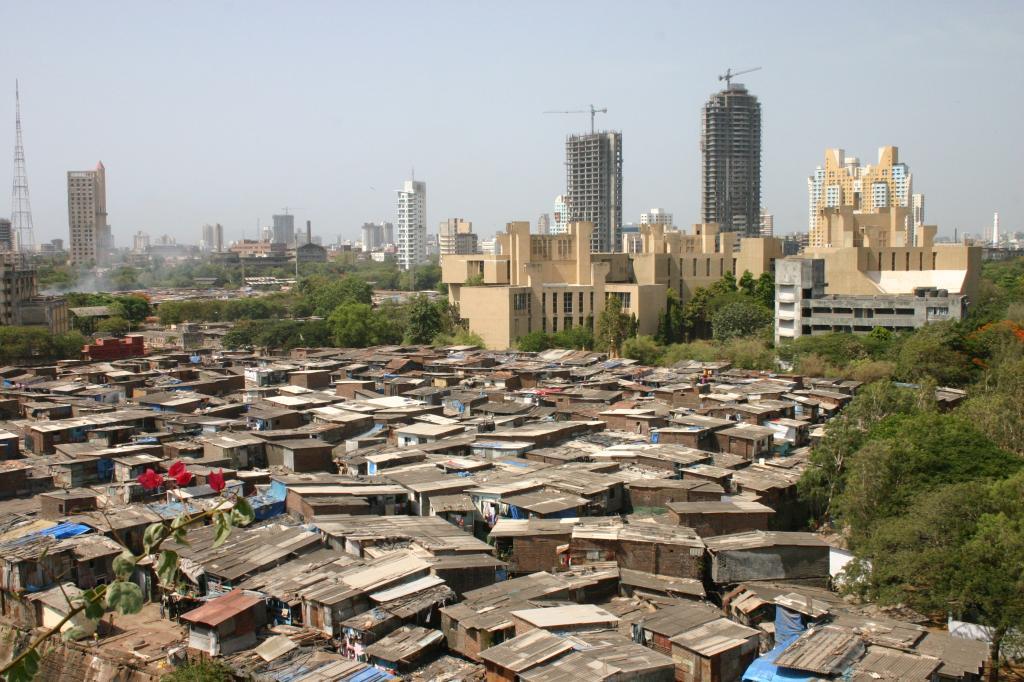

Photo credit : Wikimedia

Inequality in India has surged dramatically since the early 2000s, with the top 1% of the population holding 22.6% of the income and 40.1% of the wealth in 2022-23, as detailed in a working paper titled “Income and Wealth Inequality in India, 1922-2023: The Rise of the Billionaire Raj.” Authored by Thomas Piketty, Lucas Chancel, and Nitin Kumar Bharti, this paper highlights the stark increase in wealth concentration, especially between 2014-15 and 2022-23.

In 2014, Narendra Modi came to power with promises of development and economic reform. However, his tenure has been marked by an increasing wealth gap between the affluent and the rural poor, even as India’s economy grew at a brisk 8.4% in the last quarter of 2023. The Congress party, India’s primary opposition, has criticized Modi’s administration for its cozy relationships with billionaires, particularly in the lead-up to the general elections starting April 19.

The paper reveals that by 2022-23, the income and wealth shares of India’s top 1% were at their highest historical levels. India’s top 1% income share now ranks among the highest in the world, surpassing countries like South Africa, Brazil, and the US. The authors suggest that India’s income tax system may be regressive, exacerbating wealth disparities. Inadequate education has left many trapped in low-paying jobs, hindering the economic advancement of the bottom 50% and middle 40% of the population.

The World Inequality Lab calls for a revamp of the tax code to consider both income and wealth, along with significant public investments in health, education, and nutrition. Such measures are essential to ensure that the broader population benefits from globalization, not just the elite. The paper also proposes a “super tax” of 2% on the net wealth of the 167 richest families in 2022-23, which could generate 0.5% of national income in revenue, providing crucial funds for public investment.

Despite government efforts like subsidized grain distribution, spending on education and health, and direct cash transfers through a rural jobs scheme, inequality remains rampant. In December 2023, the Chief Economic Adviser highlighted these measures as steps towards equitable income distribution. However, the paper criticizes the poor quality of economic data in India, which complicates the analysis of inequality trends.

Historically, the income share of India’s top 1% has seen significant fluctuations. From 13% in 1922, it rose to over 20% during the inter-war period, then fell to 13% in the 1940s around the time of independence. After a brief rise in the 1950s, it declined steadily to 6.1% by 1982, likely due to socialist policies. However, economic reforms starting in the 1980s and culminating in the 1991 liberalization reversed this trend. Since the early 1990s, the top 1% income share has steadily increased, reaching a peak of 22.6% in 2022.

The liberalization of 1992 opened India’s markets to foreign investment, resulting in a surge of billionaires. Forbes data shows that the number of Indians with net wealth over $1 billion grew from one in 1991 to 162 in 2022. This wealth concentration is epitomized by Asia’s richest men, Mukesh Ambani and Gautam Adani. The 10,000 wealthiest Indians hold an average of Rs. 22.6 billion each—16,763 times the national average—while the top 1% own an average of Rs. 54 million.

The paper’s wealth inequality analysis spans from 1961 to 2023, using tax data dating back to the British-enacted Income Tax Act of 1922. This extensive dataset allowed the authors to examine the evolution of the top 1% income share over a century, concluding that the modern “Billionaire Raj” is even more unequal than the British Raj.

As India faces this growing inequality, it is imperative to address the systemic issues that perpetuate wealth concentration. Implementing progressive tax reforms, investing in public services, and creating opportunities for all citizens are crucial steps towards a more equitable society. Economic growth must be inclusive to ensure that its benefits are shared broadly, not just among the elite. The legacy of the Billionaire Raj highlights the urgent need for policies that promote social justice and economic fairness.

0 Comments

LEAVE A COMMENT

Your email address will not be published