On July 23rd 2020, Mohammad Atiqullah Khan Masud, the late founder of the Janakantha newspaper, wrote to one of Prime Minister Sheikh Hasina’s most influential advisers. Addressed to Salman Fazlur Rahman, his letter was a plea for survival—a request for a $30 million loan from the state-owned Janata Bank, a sum that could save or ruin his ailing businesses.

As the investment and industries adviser, Rahman had an informal purview over government offices relevant to business affairs. However, his position did not grant him the power to direct a state bank to disburse funds at will. There were more than half a dozen similar advisers and dozens more formal cabinet ministers; Rahman was just one among many.

Salman Rahman, however, was no ordinary adviser. He controlled the Beximco Group, one of the country’s largest industrial conglomerates. Officially tasked with improving the business environment, he also had a hand in the government’s diplomatic and political manoeuvring. He was “a supreme powerbroker,” said a Western analyst.

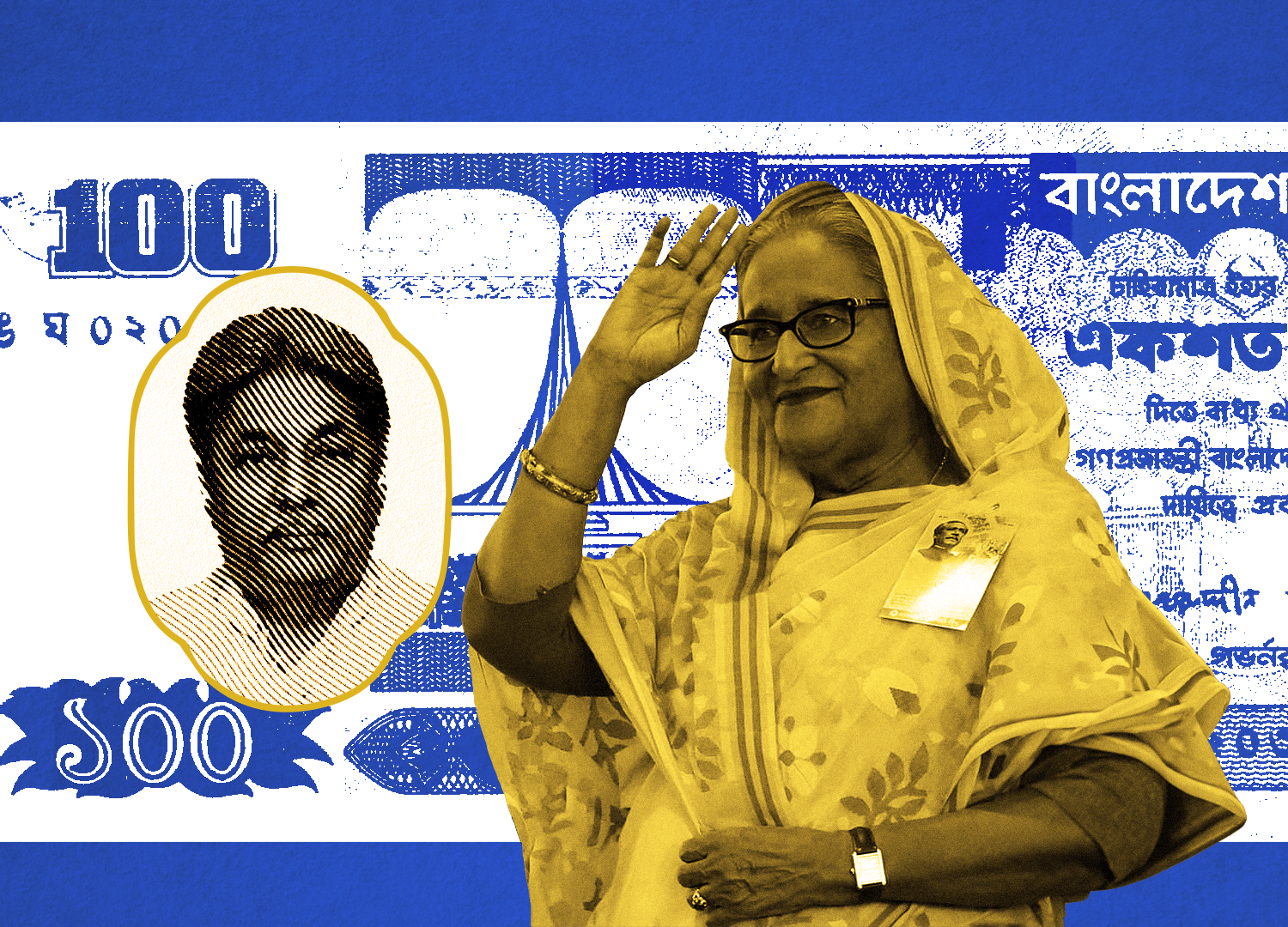

More importantly, he was one of the largest clients of Janata Bank—the same bank from which Masud was seeking assistance. Recent reports, which emerged following the fall of Hasina’s regime, reveal that over 60% of the more than $3 billion owed by Beximco Group and other unrelated subsidiaries to Bangladeshi banks came from none other than Janata Bank.

If there was one person who could help with Masud’s troubles at Janata Bank, it was Rahman. And if there was one person whose words were an edict for Rahman, Masud claimed to have that person’s backing: Prime Minister Sheikh Hasina herself, writes Masud in the letter, wanted Rahman to help him with his difficulties.

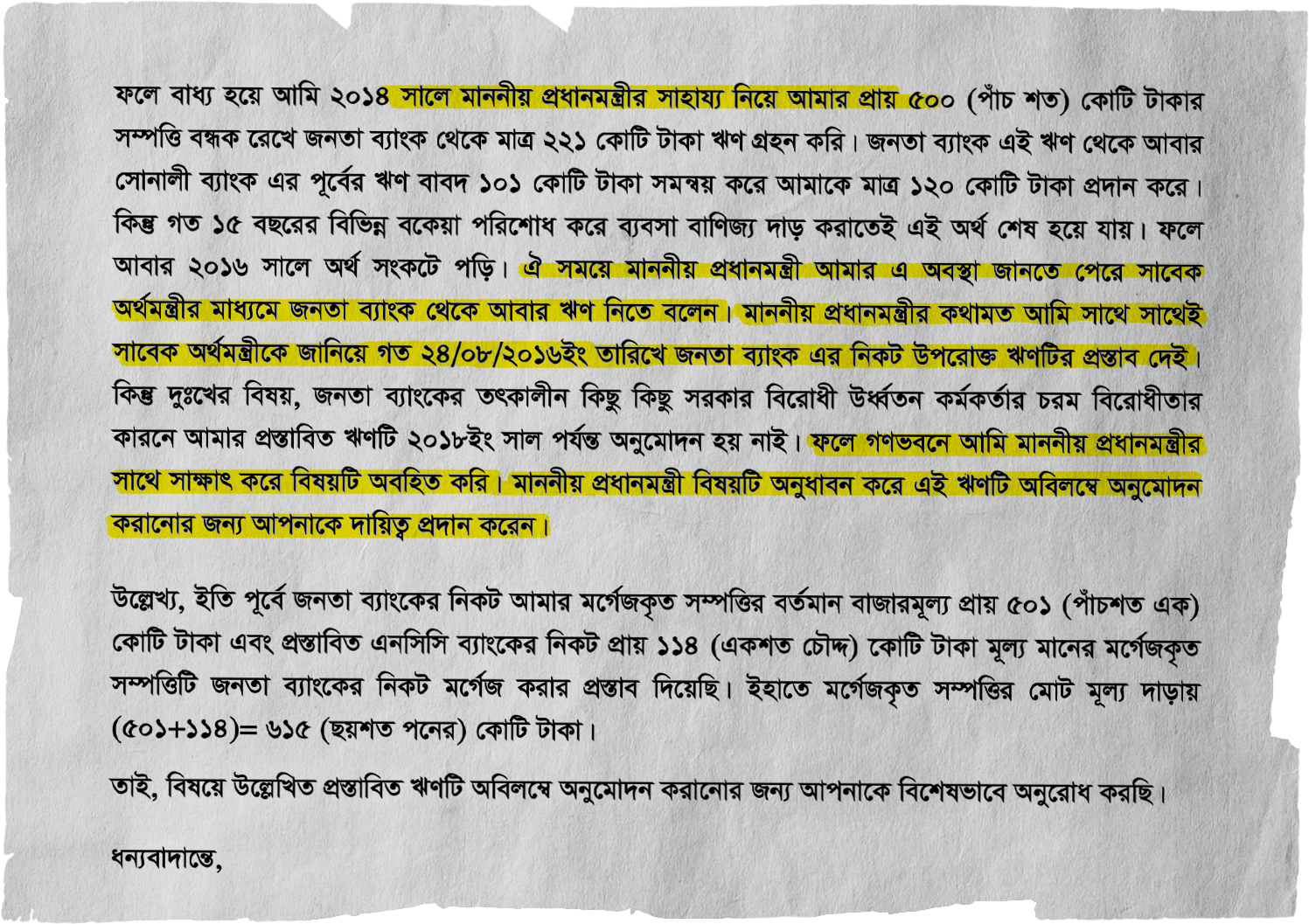

“I met with the honourable prime minister at Ganabhaban and informed her of the situation. She tasked you with ensuring my loan request was approved as soon as possible,” Masud wrote, reminding Rahman of a prior conversation.

Rahman responded quickly, drafting his own letter to Janata Bank urging them to approve Masud’s loan. On paper, the letter should have had no official effect, as it was merely advisory. Yet Janata Bank swiftly acted on it, granting a loan they had previously rejected.

The strange episode surrounding the loan’s approval process was first reported by Dhaka Post in December 2020. In recent months, The Daily Star and Prothom Alo newspapers revealed how Salman Rahman advocated for the loan. However, Masud’s letter describing Sheikh Hasina’s blessing for the move has never been reported until now.

For 15 years, Hasina ruled Bangladesh with an iron fist, fostering an environment where even hinting at her involvement in scandals was seen as treasonous. This letter marks one of the first known records of her direct involvement in a major corrupt act. The episode also provides a rare insight into how her inner circle insulated her from numerous scandals that rippled through her administration.

Hasina’s blessings

Masud’s original letter, marked “Draft” at the top and sent from the company’s official email address, never made it to Janata Bank. Before issuing his own endorsement for Masud’s loan request, Rahman admonished him for mentioning Hasina’s name, according to a person familiar with the exchange.

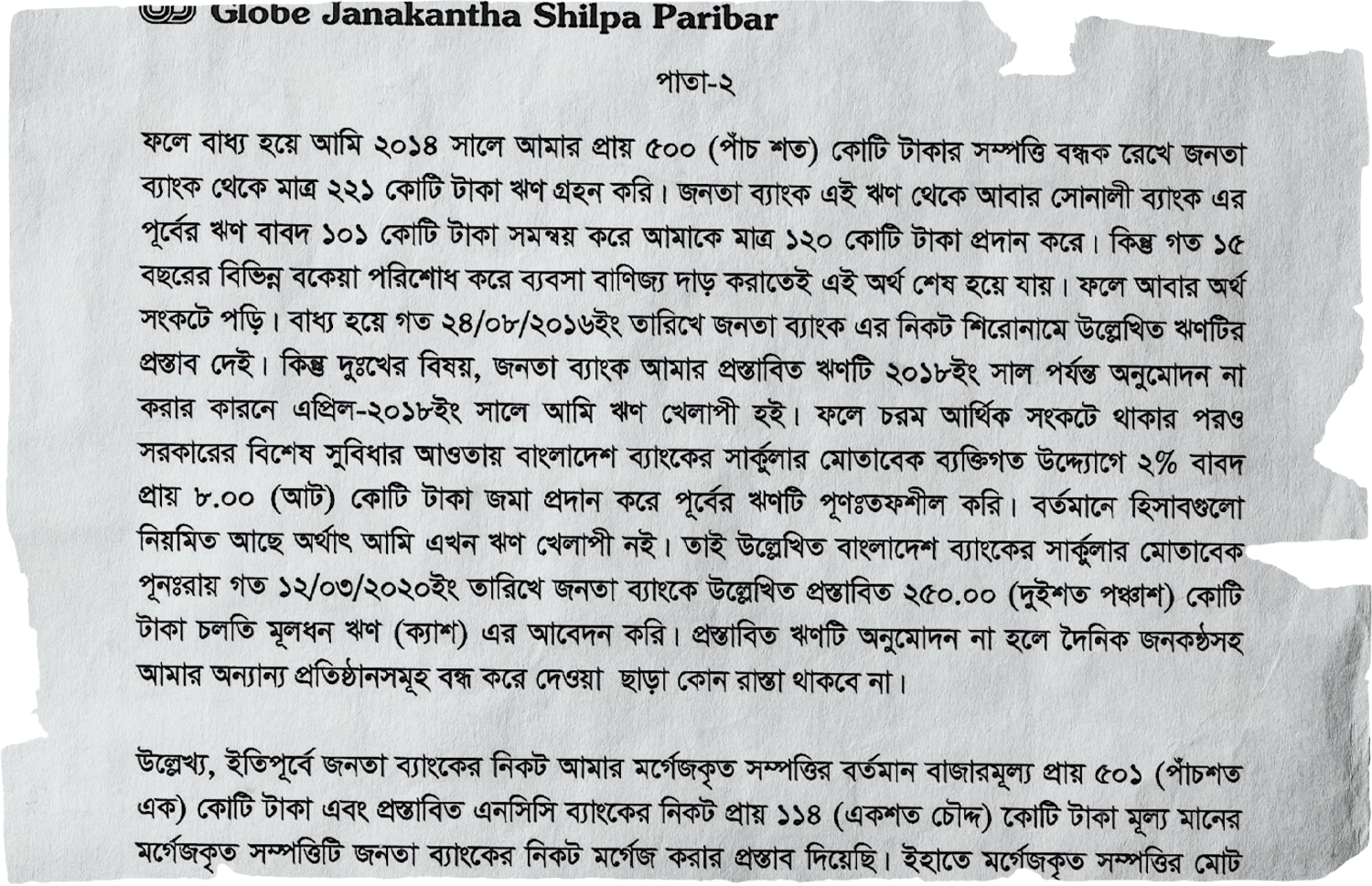

Masud was asked to rewrite his letter, removing all references to Hasina’s involvement. The final version, which eventually landed on the desks of Janata Bank’s executives, was scrubbed clean of any mention of Hasina.

In the original version of the letter (left), Masud mentions Hasina’s assistance in securing bank loans. In the edited and final version (right), all such references are removed.

In the original version of the letter, Masud referenced at least two previous occasions when Hasina had intervened on his behalf.

In his initial appeal to Rahman, Masud depicted a scene of political retribution that had left his businesses in ruins. During the BNP government’s rule that had ended 14 years earlier, his companies were hit with crippling back taxes, and Janakantha—a staunchly pro-Awami League publication—was cut off from crucial government advertising, he alleged. Matters worsened when he spent two years in jail during the military-backed caretaker government. “Due to the oppression of these two regimes, most of my businesses were forced to close, and Janakantha suffered massive financial losses,” he wrote.

He reminded Rahman of Janakantha’s unwavering support for Hasina since its founding in 1993. “For 27 years, I worked tirelessly, from dawn until dusk, in full support of the honourable prime minister and the Awami League,” Masud offered, laying the foundation for why he felt entitled to political favours.

He also revealed how Hasina had rewarded his loyalty over the years.

With her “help,” he secured a 221 crore BDT loan (about $27 million at the time) from Janata Bank. However, he accessed only 120 crore after some of the funds were used to settle old debts at Sonali Bank. By 2016, Masud had defaulted on the loan that Hasina had helped him secure, and his financial woes were mounting once again.

“After learning of my difficulties, the honourable prime minister instructed me to take another loan from Janata Bank through the former finance minister,” he recalled, reflecting on Hasina’s generosity.

Following her advice, on August 28th 2016, Masud approached then-Finance Minister Abul Maal Abdul Muhith for another $26 million loan. This time, however, his efforts met resistance from “anti-government officials” within Janata Bank, he claimed.

By 2019, Masud’s financial troubles had spiralled. Then-Finance Minister Mustafa Kamal publicly named Globe-Janakantha Shilpa Paribar among Bangladesh’s top 300 loan defaulters.

Yet Hasina came to his rescue once more.

Following a personal meeting at her official residence, Ganabhaban, Masud recounted how she instructed Rahman to intervene again and ensure he received the 250 crore BDT loan he had been pursuing.

Shortly thereafter, the Janata Bank’s board approved his loan request.

Neither Hasina nor Janata Bank responded to Netra News’s requests for comment. Rahman, now imprisoned on various charges, was also unavailable for comment. His son, Shayan Rahman, did not respond to a request for comment on his behalf.

Officials at Globe-Janakantha Shilpa Paribar, Masud’s business conglomerate, could not confirm or deny whether the company’s late owner indeed sent the letter. The current chairperson of the company, Masud’s wife, Shameema Khan, was claimed to have been unaware of the matter as well. “The chairperson ma’am has no awareness about the email or this correspondence from the perspective of the company,” said Afizur Rahman, the group’s chief operating officer. Badal Saha, its banking officer, acknowledged the 250 crore BDT loan was irregular. Both claimed the company was trying to sell its unmortgaged assets to regularise the loans.

By June 2024, two months before Hasina’s fall from power, Bangladesh’s non-performing loans had reached a record high of over $15 billion—around 4% of the country’s GDP. Despite COVID-19 pandemic-era concessions allowing large defaulters like Masud to restructure their debts, often by repaying as little as two percent of the outstanding amounts, the crisis continued to grow. Janata Bank, in particular, recovered only 13% of its targeted bad loans last year, making it the worst performer in the sector.●

source : netra.news