by Hamayun Khan and Saed Mansoor Sadat 7 May 2020

The fast-track spillover of the novel COVID-19 across the globe has spiked concerns over the prospect of the economic ramifications after complete demolish of the pandemic. As projected by the ASEAN+3 Macroeconomic Research Office in 2020, the outbreak of the COVID-19 will reduce as much as half a percentage point from the current economic growth of some regional economies in 2020. On the other hand, the rampant spread of the pandemic exasperating the already depressed economies and markets in different countries, including Afghanistan. Afghanistan is already suffering from different angles such as insecurity, a high rate of Inflation, and unrestricted circulation of foreign currencies. Adding the prevailing unprecedented crises caused by the COVID-19 is yet another premonition for the ailing market, particularly for the Micro, Small, and Medium Enterprises (MSMEs) in Afghanistan.

The outbreak of the pandemic has posed enormous challenges for private sector and sole proprietors in Afghanistan. This is going to engender several other problems such as an increase in unemployment and poverty. For example, the recently published reports by Ministry of Economy indicate that unemployment will rise by 40% and poverty will increase by 70% in Afghanistan, mainly due to the spread of the COVID-19.In addition, the Government’s sloppy policies and contingency plans have failed to prevent and combat the spread of COVID-19. This is most likely because of the retrospective market infrastructure in Afghanistan which molds the MSMEs and private sector to suffer unemployment problem. Furthermore, a most recent statement made by the Ministry of Martyrs, Disabled & Public Affairs highlights that the outbreak has triggered unemployment trend to increase specifically within the private sector, street vendors, and sole proprietors in particular.

Appearing steady yet menacing, the spread of COVID-19 in Afghanistan has led to a high rate of inflation in the country, mainly in the eastern region (i.e. Nangarhar province). Nangarhar’s significant strategic location – having the country’s largest trade harbor (Turkham) with Pakistan, makes the province a pivot-hub for trade and commerce. Also, the currency of Pakistan (Rupee) has been in circulation in the markets of Nangarhar for decades. Predominantly the Rupee is used as a transactional currency in those markets posing financial fallout for the local vendors when the Rupee fluctuates or its value depreciates against the Afghanistan Afghani. However, after the result of presidential election- announced in January, 2020, a number of investors and Entrepreneurs were optimistic for the facilitation of a new fold for MSMEs. But troubles for Markets in Afghanistan have doubled.

In addition, the use of Rupee in the markets of several other provinces bordering with Pakistan, has started since the civil war intensified in the 1990s, followed by the Taliban’s regime (1996-2001). Nonetheless, local authorities in the past have made several attempts to ban the use of Rupee but they were failed due to improper policies and insufficient support by local people. Similarly, a few months ago the Governor of Nangarhar province imposed an abrupt ban on the use of Rupee thinking that the sanction would avert the consequences. But the move has proven otherwise both for the local vendors and MSMEs.

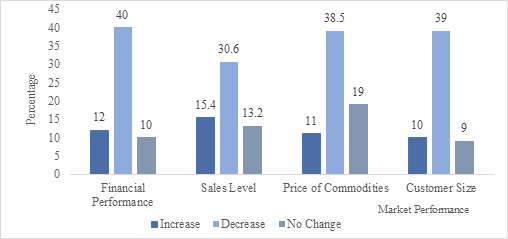

To examine the impact of Rupee on the business performance of MSMEs in Nangarhar, we conducted a survey between December 2019 and January 2020. The survey data indicates that there is a considerable decrease in the financial performance and sales level of small scale businesses in the province. As shown in the figure below, the price bar, on the other hand, shows comparatively more decrease because it implies the inflation rate that is going high during the imposed lockdown. Similarly, customer size also witnesses a substantial fall because of the hike in prices.

The inferences drawn from the data shows two major issues concerning Rupee circulation: (1) mismatch between the two currencies (i.e. Afghani and Rupee); and (2) discrepancy between the revenue generation and customer retention. Fluctuation in the rate of Rupee has created a mismatch between these two currencies leading to a financial loss for the wholesalers and retailers. This is because most of the wholesalers in Nangarhar import goods from Pakistan using only Rupee, which is lower in value than Afghani (i.e. Afn1=Rs 2.10- as per the current market rate). On the contrary, the wholesalers use both Afghani and Rupee while selling over the products to retailers, which results in a currency mismatch and ultimately a financial loss.

Discrepancy between customer retention and profit-making is another hurdle hindering the revenue generation of MSMEs in Nangarhar province. The proprietors, who make transactions using Rupee are stranded in a dilemma whether to prefer revenue generation or retain the prospect customers. Choosing solely one between these two while overlooking the other or maintain an equal balance will likely result in the vendors to either lose customers or face a fall in profit.

The outbreak of the pandemic deters operations of the economically affected markets not only in Nangarhar province, but markets throughout the country. Additionally, it triggers a high demand for disinfectants. Nonetheless, local vendors leverage this eruption by skimming the free-market demanding for hygienic equipment primarily purchased to avoid infections of the contagion. With the increase in positive cases, people begin to anguish, and try to take necessary control measures, so much so the industrialists capitalize and see this crux as a lucrative opportunity. However, marketers and proprietors claim, they try to approach the customers to fulfill their demands; still citizens slam them for rampant increase in inflation. Fast-Moving Consuming Products (FMCGs) that were earlier sold between the prices of Afs10 to Afs30 are now tagged with Afs100 and above. Moreover, prices of grocery items are also hit by a high rate of inflation.

Given the prevailing trying times, the unfair marketing policies adapted by local vendors – prioritizing profit over customer value will harm their businesses both in long and short term. Unplanned sanctions by the local authorities are not effective and will solely devise inflation for the public and financial losses for vendors.

MSMEs are required taking customer value and streamlining the quality of products. The central Bank (Da Afghanistan Bank) and other concern bodies within the Government should reconsider the monetary policy – thus implement and mainstream the outlined rules to limit the free flow of foreign currencies, and to shun the use of Pakistani Rupee by replacing it with Afghani. People are also required working concertedly with the government to prevent the use of Rupee and its volatility impacts.

Thank you for the informations

Dear Mr. Editor,

Hamayun Khan is the first author of the article, after correction, his name has now written as the 2nd author.

Therefore, it is a kind request to make him the first author of the article, and allow him make more contributions to SAJ in the future.

Sincerely yours,