- Issue Briefs and Special Reports Mar 11 2020

After a hiatus of almost two decades, the Bay of Bengal Initiative for Multi-Sectoral Technical and Economic Cooperation (BIMSTEC) appears poised to once again assume significance in regional affairs. The renewed vigour has already resulted in a fresh agreement on tangible areas of cooperation and ways of resuscitating the organisation. This brief examines the role that will be played by technology and digital skilling in BIMSTEC’s goals towards facilitating the development of the region, particularly in the maritime domain. It will train the spotlight on Sri Lanka, which is the lead country for BIMSTEC’s cooperation in the technology sector.

Attribution: Soumya Bhowmick and Pratnashree Basu, “BIMSTEC and the Fourth Industrial Revolution: The Role of Technology in Regional Development,” ORF Issue Brief No. 344, March 2020, Observer Research Foundation.

Introduction

In 2015, India upgraded its ‘Look East Policy’ to ‘Act East’[1] to enhance the country’s economic cooperation, cultural ties, and strategic relations with the extended neighbourhood. Indeed, since 1992, India’s trade with countries of the Association of Southeast Asian Nations (ASEAN) has grown from US$2 billion to over US$76 billion by 2018.[2] Today India seeks deeper engagement and institutional integration in the region, primarily through its participation in regional groupings such as the Bay of Bengal Initiative for Multi-Sectoral Technical and Economic Cooperation (BIMSTEC), the Mekong–Ganga Cooperation (MGC) Initiative, and the East Asia Summit (EAS).

Conceived in 1997,[3] BIMSTEC is a grouping of seven countries in South Asia and South East Asia: India, Bangladesh, Sri Lanka, Myanmar, Thailand, Nepal, and Bhutan. At the Brazil-Russia-India-China-South Africa (BRICS) summit in 2016, Indian Prime Minister Narendra Modi undertook an outreach exercise with the leaders of the BIMSTEC countries. In 2019, PM Modi invited these heads of states to his second-term swearing-in, highlighting the importance that his government is giving to those countries. (Earlier, in his 2014 oath-taking, Modi invited the leaders of the South Asian Association for Regional Cooperation or SAARC.[4])

In recent years, there has been renewed hopes for a more robust BIMSTEC, on two accounts: first, the stagnation of SAARC, largely owing to Pakistan’s obstructions, alongside India’s fears over the involvement of China in the almost-annulled Bangladesh-China-India-Myanmar (BCIM) Economic Corridor; and second, India’s non-participation in China’s Belt and Road Initiative (BRI), making it more important to strengthen India’s own strategic and economic ties in South Asia. India’s Act East Policy—and within it, BIMSTEC, in particular—is seen as a critical alternative to the country’s non-participation in the BRI. A crucial driver of this policy is India’s Northeast, as seen in a renewed infrastructure push in the region.[5]

To be sure, BIMSTEC showed promise even in its early years; it has met with little success, however. It is widely believed that as Chair, Sri Lanka has exhibited little interest in BISMTEC’s development as compared to the enthusiasm it has accorded the SAARC.[6] Going forward, if BIMSTEC is to overcome its stagnation, it has to move beyond reactive regionalism.[7] It can begin on a note of recognising the massive economic importance of the Bay of Bengal region, for two reasons: its location is strategic, connecting the product markets across South Asia; and it is home to potent market catalysts including social capital (diversity, cultural vibrance); physical (maritime connectivity, potential energy supply hubs); human (skilled and cheap labour); and natural (minerals and forests). BIMSTEC can therefore serve as an apt medium for enhancing cooperation in operationalising new frameworks of technology, geopolitics, environment and society.

BIMSTEC, 4IR, Technology and Skilling

After the 2nd ministerial meeting in Dhaka in 1998, the BIMSTEC states identified six priority sectors for cooperation. More sectors were added after the 8th ministerial meeting in Dhaka in 2005 and one more after the 11th BIMSTEC Ministerial Meeting in New Delhi in 2005. (See Table 1 for the complete list of the 14 lead areas of BIMSTEC cooperation.[8])

Table 1: Priority Areas of Cooperation under BIMSTEC

| Sectors | Lead Countries |

| 1. Trade & Investment | Bangladesh |

| 2. Technology | Sri Lanka |

| 3. Energy | Myanmar |

| 4. Transportation & Communication | India |

| 5. Tourism | India |

| 6. Fisheries | Thailand |

| 7. Agriculture | Myanmar |

| 8. Cultural Cooperation | Bhutan |

| 9. Environment and Disaster Management | India |

| 10. Public Health | Thailand |

| 11. People-to-People Contact | Thailand |

| 12. Poverty Alleviation | Nepal |

| 13. Counter-Terrorism and Transnational Crime | India |

| 14. Climate Change | Bangladesh |

Source: “Areas of Cooperation,” BIMSTEC, https://bimstec.org/?page_id=199

More recently, at the 4th BIMSTEC Summit Declaration 2018, Thailand proposed more focused pillars of cooperation in order to reorganise and prioritise the sectoral engagement of the grouping.[9] Taking a cue from this, during the 16th Ministerial Meeting, Thailand’s Foreign Minister outlined five prioritised sectors: connectivity; trade and investment; people-to-people contact; counterterrorism; transnational crime and security; and science & technology.[10]

This brief highlights science and technology amongst the priority sectors, given its crucial role in operationalising all the other development agendas and allowing the region to keep pace with the Fourth Industrial Revolution (4IR).[11] After all, technological innovation has ramifications on a wide range of sectors including trade, counterterrorism, and harnessing people-to-people contact. The technology domains that shape the 4IR include: Artificial Intelligence, data processing and dissemination, blockchain, Internet of Things, unmanned aerial vehicles, human gene editing, and cyber security. These applications shape not only national policy designs but also international cooperation on various global platforms.[12]

As early as during its inception in 1997, BIMSTEC had already identified technology as one of its priority areas for cooperation. At that time, the BIMSTEC states sought to create and exchange technology towards the achievement of goals in agro-based industries, food processing, herbal products, biotechnology, and ICT-related industries.[13] Given that South Asia and East Asia were predominantly agrarian during that period—and their state of industry were younger than that of the western world—the use of technology in the region was predominantly aimed at moving agrarian goods up their value chains.

Today, the BIMSTEC countries are generally similarly placed in their economic and technological state. The current priorities for enhanced cooperation include scientific research, software and hardware development, joint R&D, and Geographical Information Systems (GIS). The BIMSTEC states are aiming to focus on technological skilling to incorporate an enabling framework for the digital economy that will do the following:

– provide the cross-country businesses to create and participate in the regional and the global value chains;

– make use of digital marketplaces and e-commerce platforms which are fast-paced and robust;

– stimulate producers to be more efficient, innovative and productive; and

– remove the barriers impeding the developing countries such as inefficient logistics, deficient trade and inaccessible markets.[14]

Taking the lead in BIMSTEC’s science and technology initiatives is Sri Lanka. As early as in 2008, the BIMSTEC leaders had established the BIMSTEC Technology Transfer Facility (TTF) in Sri Lanka.[15] (See Table 2 for the efforts undertaken so far in this sector.)

Table 2: BIMSTEC efforts in the domains of science and technology

| Year | Meetings/Summits | Proposals |

| 2006 | Eleventh Senior Officials Meeting, Colombo, Sri Lanka. | Proposal to establish a BIMSTEC Technology Transfer Exchange in Sri Lanka. |

| 2006 | Ninth Ministerial Meeting, New Delhi, India. | Emphasis on – cooperation in advanced areas of fundamental scientific research; exchange of expertise in software and hardware development; joint R&D in this field; technology transfer and exchange of experience on Geographical Information System (GIS). |

| 2008 | Second BIMSTEC Summit, New Delhi, India. | Decision to establish a BIMSTEC Technology Transfer Facility in Sri Lanka. |

| 2014 | Third BIMSTEC Summit, Nay Pyi Taw, Myanmar. | Enhancing cooperation in expanding skill and technology base of BIMTEC member states through partnerships that are targeted towards Micro, Small and Medium scale Enterprises (MSMEs). Decision to accelerate efforts for the finalization of Memorandum of Association on the Establishment of BIMSTEC Technology Transfer Facility in Sri Lanka. |

| 2016 | BIMSTEC Outreach Summit and Leaders’ Retreat, Goa, India. | Emphasis on the establishment of BIMSTEC Technology Transfer Facility in Sri Lanka to help MSME sectors in the member countries. |

| 2017 | The Fourth Meeting of the BIMSTEC Expert Group on the Establishment of BIMSTEC Technology Transfer Facility, Colombo, Sri Lanka. | The draft text of the Memorandum of Association (MoA) of the BIMSTEC Technology Transfer Facility was finalized. The proposed budget for the facility was also prepared for submission to the Nineteenth Session of the BIMSTEC Senior Officials’ Meeting. |

Source: “Technology,” BIMSTEC, https://bimstec.org/?page_id=266

As the digital economy in Asia shows a phenomenal boom, Southeast Asia’s alone is expected to surpass US$ 200 billion by 2025.[16] The question is whether or not BIMSTEC will be able to ride this trend to its full potential. More importantly, the onus is on Sri Lanka to guide the BIMSTEC’s technological growth amidst its own issues[17] in politics, digital infrastructure, skill levels, regulations and FDI. Much is expected from Sri Lanka for the adoption of a digital ecosystem and investing in technological skilling in the region, in consonance with its own National Digital Policy 2020-2015,[18] and more importantly in enacting a functional TTF for the BIMSTEC platform. According to the Digital Maturity Quotient framework of McKinsey, Sri Lanka scored 35 which is two units higher than the global median of 33, with demonstrated strengths in connectivity, digital marketing, investment in digital initiatives and importantly, the ability to act swiftly on various platforms.[19]

A mathematical formulation for technological advancement

Both neoclassical and endogenous growth theories explain poverty in developing countries by the differences in technology levels. The latter theories specifically attribute the gap in idea endowments and differences in technological absorptive capacity for low income in the less developed nations. The aim of technology diffusion in contemporary times is to attain economic convergence between the countries, driven by trade in technology. The gap in cross-country income levels will narrow down if technologically younger nations are able to upgrade their science and technology domain at a faster rate than the advanced nations.[20]

Global integration has helped technological latecomers such as the BIMSTEC nations, gain access to advanced technologies. This has not only helped in increasing per capita income but also augmenting Total Factor Productivity (TFP) in the low income countries.[21] Empirical studies[22],[23],[24] show that countries that have imported from the world’s technology leaders have experienced faster growth in TFP. BIMSTEC as a platform also needs to implement this by identifying suitable partners for technology imports and know-how – for example the grouping of Digital Nations[25] network or erstwhile D5—and then focus on the regional diffusions of technology amongst the concerned stakeholders in the Bay of Bengal. The TTF in Sri Lanka needs to focus on technology imports from advanced states, both general purpose technology and sector-specific ones, for the overall development of the region.

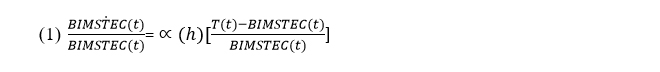

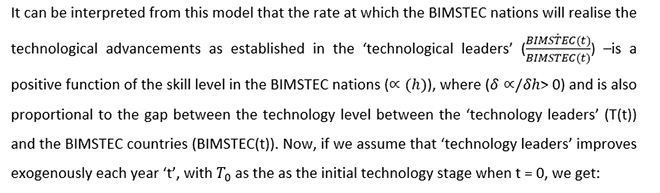

Digital skilling is one of the core areas under BIMSTEC’s technology domain that needs a renewed thrust, simply because penetration of new technology and the status of domestic skill sets are closely linked. In fact, for low- and middle-income countries such as the ones in BIMSTEC, as the GDP ratio of technology imports has increased over time in labour-intensive sectors, it has not helped much in increasing labour productivity or demand for skilled labour.[26] As most of the countries in BIMSTEC are relatively low-ranked in terms of per-capita incomes and are still transitioning to come at par with the advanced technological nations – their interaction with the technological leaders of the world can be effectively illustrated by building up on a model formulated by Nelson and Phelps,[27] as described thus:

Finally, the study[28] derives the equilibrium path of technological development, which is the BIMSTEC forum in this case, as thus:

Therefore, the potential level of technology which is employed by the BIMSTEC countries depends on: 1) its own educational attainment ‘h’ which determines the digital skill level of the country; and 2) the constant exponential rate ‘δ’ of technological advancement in the ‘technological leaders’ – and these advancements are now available to the ‘technological latecomers’ due to globalisation.[29]

If the production function in the BIMSTEC countries are characterised by negligible elasticity of substitution between imported technology and domestic skilled labour, the returns are rapidly decreasing to marginal increases in either imported technology or domestic skilled labour alone, unless there exists rising supply of the other as well.[30]Thus, governments at both national and supranational levels such as the BIMSTEC, need to work simultaneously on easing technological imports by reducing costs and working on skilling the domestic labour force that assesses and absorbs digital mechanisms in a more effective manner, and enhances the human capital base of the countries.

Technology in Maritime Spaces

With Sri Lanka at the helm, BIMSTEC’s cooperation in technology can steer the member-states to enhanced cooperation in the maritime domain. As the Bay of Bengal assumes greater significance in the geostrategic policy frameworks of not only the Bay littorals but also extra-regional powers—and as the region continues to attract increasing volumes of maritime commercial traffic—the preservation of maritime security becomes even more essential. While this is a task which the BIMSTEC members are best suited to perform simply because of their geographical locations, it also requires concerted efforts towards requisite skilling initiatives and relevant policy formulation to facilitate effective ways of implementation.

Sri Lanka is one of the most strategically positioned countries in the Indian Ocean Region, and thus has a pivotal role to play in terms of technology upscaling in the BIMSTEC in the maritime domain.[31] The areas for technological cooperation include the following:

- Digital transformations in maritime networks, easing trade connectivity, and encouraging technology-driven public goods such as common internet zones to harness the scale economies in the region.

- Investing in maritime security in order to protect the region from non-traditional threats as well as natural disasters. One of the ways could be to follow the 2016 Indonesia-Malaysia-Philippines model of setting up a hotline for better emergency responses to combat piracy and kidnapping, and bolster the security in the neighbouring seas.[32] The first BIMSTEC conference on drug trafficking held in New Delhi in February 2020 offers the opportunity for deliberating on the increased threats posed by this issue and the ways of mitigating the same, together with the best practices which can be employed to curb drugs-related crimes.[33]

Upscaling the region’s ports

Ports are the bedrock of maritime connectivity and serve as integrated logistics centres for maritime trade by functioning as the connecting dots of global supply chains. With increasing interdependence amongst countries with respect to economic interactions, much depends on the logistics and infrastructure of ports as seaborne trade accounts for almost 90 percent of global trade.[34] The United Nations Conference on Trade and Development (UNCTAD) estimates international maritime trade to expand at an average annual growth rate of 3.5 percent over the period 2019–2024, with the foremost drivers being container, dry and gas cargoes.[35] Seaports are regarded as important Third Party Logistics (3PL) providers covering transport, logistics, distribution and spatial functions.[36] It is estimated that competition amongst ports will be deepening due to the intensification of alliances between shipping companies prompted by market demand contractions which in turn will require ports to advance in efficiency, and upgrade and maximise their containership capacity.[37] Consequently, terminal operators at seaports would be increasingly looking to utilise digital technologies and automation to improve competencies as well as adaptability. (See Table 3 for a list of the most important applications of technology in the port industry.[38])

Table 3: Tech Applications in the Port Industry

| Technology | Application and Value | Examples |

| Internet of Things | Monitor physical logistics flows, collect and monitor data, enable intelligent decision-making, optimise processes. | The Port of Hamburg uses intranets, cloud computing, mobile terminal equipment, the Internet of Things, and Big Data technologies to manage the port area, parking lots, terminal and roads.Intelligent ships reduce oil consumption and monitor shipping |

| Drones;Driverless trucksCrewless ships | Eliminate or minimise manned operations, improve efficiency and shipping security | Ports use drones to monitor discharges; ships use drones to deliver paper documents.Starship Technologies is testing its revolutionary self-driving delivery robots in London. |

| Robots | Undertake standardised process-based operations to improve efficiency | Amazon uses robots in its warehouses to manage and deliver goods |

| 3D printing technologies | Turn mass production into customised and distributed production | The Port of Rotterdam uses 3D printing technologies to support the maintenance and repair of parts and accessories. |

| Big Data | Provide data analysis and insights, identify opportunity and risk, and maximise efficiency. | The Maritime and Port Authority of Singapore integrates real-time data through a unified platform, using aggregation analysis, anomaly analysis and data mining to develop transportation monitoring tools, and monitor and detect vessel anomalies to improve port security.Through its dynamic process management program Damco Dynamic Flow Control, Damco analyses and optimises supply chain data, reduces logistics and time costs, and simplifies processes. |

| Cloud computing | Build port communities, facilitate the deal process | Trucker Path and Cargomatic have launched apps to facilitate deal making, reduce idle transportation and improve the efficiency of trucking. |

Source: Connected Ports Driving Future Trade, Accenture and SIPG, 2016,

All BIMSTEC member states have ports with deepwater terminals. In 2019, the first BIMSTEC Ports Conclave discussed technological solutions to optimise efficiency, the utilisation of resources, time and energy, and green port operations.[39] The adoption of digital practices will benefit the maritime industry in two principal ways: monitoring and systematisation. Digitalisation in the coming years will prove essential for maritime commerce because of the breadth of scope that it promises to offer in terms of enhancing efficiency of port operations, logistical processes, streamlining of shipping services, and the overall facilitation of end-to-end transactions and communication that comprises the entire shipping process. Smart port technologies[40] would impact infrastructure through the use of tracking sensors, real-time cargo handling, coordination of intermodal traffic, and the use of blockchain for container security, transparency and customs operations.

With ports facing the simultaneous challenges of rising volumes and boosting efficiency, digitalisation is perhaps the only way forward. In other words, the aim of digitalisation would be to facilitate multiparty exchanges in a seamless and streamlined manner, as far as possible. (See Table 4[41] for specific port requirements that drive applicable technological solutions.)

Table 4: Port Requirements that Drive Tech Solutions

| Type | Focus | Applicable Solutions |

| Emerging port | Ease of doing business | · Port community systems· Single e-window customs· X-ray scanning· Biometric access control systems |

| Local trade hub | High productivity | · Smart cargo-handling systems· Equipment management and control· Gate automation· Safety management solutions |

| Intermodel gateway | Optimised traffic across transport modes | · Truck appointment system· Traffic-monitoring systems· Integrated rail and barge platforms |

| City-based port | Minimised impact on surroundings | · Asset health monitoring· Environment and energy· Management systems· Port-wide platforms |

Source: Jens Riedl, Francois-Xavier Delenclos and Alexander Rasmussen, “To Get Smart, Ports Go Digital”, Boston Consulting Group, April 11, 2018.

The global maritime industry has been a relative latecomer to the adoption of digital functions. Port operations in many countries remain largely manual and paper-based with very little electronic data exchange. As the maritime industry involves stakeholders and participants at various levels of the network, it is not only important for all parties concerned to adopt digital technologies at their ends to augment the efficacy at all levels of the entire process, but also to enable concerned parties to cooperate on platforms without the creation of new systems. The transformation towards digital operations would require workers to be equipped with skill sets that are different from what are currently required. Technological skilling for optimisation of port operations would thus require significant investments and the transfer of requisite know-how from ‘technological leaders.’

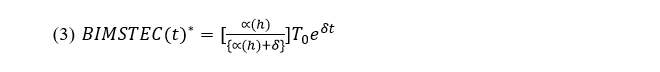

Located at a mere distance of six to 10 nautical miles from one of the world’s busiest shipping routes – the East-West Shipping route—Sri Lanka’s maritime capabilities are relatively more advanced than those of its immediate neighbours. In recent years, the country has been geared towards developing itself as a maritime hub. The country serves energy and cargo shipments through two strategic chokepoints—the Suez Canal and the Strait of Malacca. Sri Lanka has performed well on the World Bank’s Logistics Performance Index (LPI) with a ranking of 94 among 160 countries in 2018. The LPI accounts for efficiency in the clearance process, quality of trade and transport-related infrastructure, ease of arranging competitively priced shipments, competence and quality of logistics services, ability to track and trace consignments, and timeliness of shipments in reaching destination within the scheduled or expected delivery time.[42] (See Figure 1 for an illustration of Sri Lanka’s LPI index score card[43] in 2018.)

Figure 1: LPI Index Score Card for Sri Lanka

The Port of Colombo handles the bulk of ships coming to the country comprising cargo originating from and destined to Europe, East and South Asia, the Persian Gulf, and East Africa.[44] Colombo was ranked as the 13th best Connectivity Port in the world by the Drewry Port Connectivity Index in 2017, and the top container growth port among the top 30 container ports for the first half of 2018.[45] Other main seaports include Galle, Trincomalee and Hambantota, with the latter also in an advantageous location with reference to transshipment. The LPG transshipment facility at Hambantota is the largest of its kind in Asia.[46]

In terms of both geographical location as well as connectivity, Sri Lanka is well-placed to pitch itself as a maritime hub, with Colombo Port functioning as one of the fastest growing transshipment ports buoyed by modern container terminals linked with a sophisticated feeder network.[47] The strong points of the country as far as port operations is concerned include swift turnaround times and reliability. Container trucking, warehousing, shipping and ports facilities contribute to 2.5 percent of gross domestic production;[48] this highlights the scope that digitalisation is poised to contribute if digital practices are adopted to maximise efficiency. With the BIMSTEC region focusing on connectivity—which involves the inevitable role of logistics—digital systems and practices would facilitate operational efficiency, thereby boosting not only Sri Lanka’s standing as a transshipment node on the east-west shipping route but also supplementing maritime operations of littoral members.

From the perspective of Sri Lanka, it is vital to step up the drive towards digitalisation in the wake of competition from other regional ports like Singapore to the east and Dubai to the West. It is also estimated that the country’s ports remain underutilised with there being inadequate capacity to handle the rising volumes and size of vessels.[49] For India, digital practices would give a much needed boost to the underutilised ports as well as offer relief for over-burdened ports on the eastern coast. For Thailand, digital solutions would complement the ongoing infrastructure and connectivity initiatives in the country to step up development and maximise operations at the Ports of Bangkok and Laem Chabang. The upgrade of digital infrastructure will therefore be able to contribute to the optimal utilisation of the main seaports in the BIMSTEC region. Sri Lanka, together with India and Thailand, should be able to supply technological assistance to Myanmar in the context of capability additions. Colombo should also work with the Information Fusion Centre in India[50] and merge its efforts with the Indian government’s Sagarmala and SAGAR initiative—Security And Growth for All in the Region—which are focused on port-led development and maritime security.

It must be acknowledged that without India’s optimal engagement, the economic success of ports in Sri Lankan port will remain underutilised. Bangladesh too has emerged as one of the leading economies in the region with strong social indicators and a political regime that has remained largely stable. The country continues to orient its growth trajectory towards digitalisation and is poised to become a useful partner in developing this sector under BIMSTEC.[51] Landlocked nations Nepal and Bhutan also have considerable interest in the better use of technological solutions for easing their maritime access and operations via the littoral countries in BIMSTEC.

Besides maritime connectivity, technology also finds application in maritime security. The Bay region is exposed to varied security challenges which can be better mitigated through the combined efforts of BIMSTEC member countries. Digital systems would be able to assist in the monitoring of the maritime environment, including conducting of patrols, search and rescue missions, monitoring, and creating early warning systems for natural disasters and security threats such as terrorism, trafficking of drugs and weapons, illegal, unreported, and irregular (IUU) fishing, and armed robberies at sea.[52] In order to employ technology for enhancing its domestic maritime security activities, Sri Lanka would have to reorganise the allocation of domestic finances which at the moment are expended more for recurrent costs—personnel salary, installations and weapons maintenance—and create room for more weight on capital costs which would facilitate the procurement of new technology.[53]

More importantly, digital solutions would be able to contribute significantly to the capability enhancement in terms of Maritime Domain Awareness (MDA) and maritime governance of the Bay littorals. In this respect, BIMSTEC members may consider tying in their efforts with the Indian Ocean Rim Association (IORA) and the Indian Ocean Naval Symposium (IONS) to develop the organisation’s own Maritime Safety and Security agenda.[54] In late 2019, the first coastal security workshop of BIMSTEC nations was held to discuss best practices with respect to coastal security, fisheries management, port and shipping security, non-traditional threats to maritime security, and the requirements for establishing a Coastal Surveillance Radar System.[55] Other technologies for the maintenance of maritime security include x-ray, gamma ray, and neutron scanning, biometrics, Radio Frequency Identification (RFID) and remotely operated vehicles for underwater surveillance.[56]

Additionally, technology would also play a significant role in the development of the Blue Economy. The Fourth BIMSTEC Summit Declaration in 2018 brought cooperation in the sector of Blue Economy more firmly within its purview by establishing an Inter-governmental Expert Group.[57] The challenges facing the region’s ocean resources include overfishing and depleting fish stocks, which are linked with the livelihoods of coastal communities of the Bay littorals.

Conclusion

While technology is projected to make way for transformations in traditional modes of production, create productivity gains, and expand the scope of commercial opportunities, there are apprehensions regarding the potential disruptions that will accompany digitalisation such as significant shifts in operations and the loss of jobs. For instance, terminals at seaports are expected to become more “intelligent” and therefore often “unattended” in terms of monitoring security, receipt and delivery and transportation.[58]

But automated systems and process would nonetheless require management and therefore manual functions which are set to become obsolete can be converted into new jobs which would require upskilling of the existing workforce. For instance, a cyber-enabled vessel would not necessarily imply an unmanned one and thus, shipping crew in the future would find themselves handling tasks and cyber incidents that would fall somewhere in between the physical vessels on the one hand, and the monitoring systems, on the other. Automation also stands to offset the persistent challenge of shortages of seafarers.[59] E-navigation and Electronic Chart Display and Information System (ECDIS) would also require trained crew, and eventually there could be a move from labour at sea to labour on shore with modifications in the responsibilities of future seafarers.[60] As in the case of any significant transference, the shifts in terms of the seafaring workforce would have more to do with changes in the nature of the work that will be required in the wake of technological advancements, rather than the obliteration of jobs altogether.

The significant increase in the use of software-controlled ship systems or cloud-based solutions, in turn, brings into focus resultant challenges such as hacking. Therefore, digitalisation will prove vital for supply chain security, especially in the context of cyber disruptions.[61] Cyber security will undoubtedly emerge as one of the key challenges, and it will be vital for all stakeholders to find solutions and preemptive measures to counter cyber-attacks.

The BIMSTEC is unique as far as regional organisations are concerned because it straddles two contiguous regions – South Asia and Southeast Asia. Fundamentally, there is a lot of scope for the organisation to harness the potential that member countries possess. The transformation of the available potential into tangible areas of cooperation which can result in the development of the region as a whole, rests largely on the sustenance of political will and business relations amongst members. It is crucial to note that cooperation in maritime spaces has to be addressed by both governments and business communities in the member states.

The Fourth Industrial Revolution is distinctly different from the previous ones in terms of its pace, scope and impact– the exponential speed of evolving systems, the complete restructuring of institutions and arrangements, and the immense influence on the global order, respectively.[62] However, the lack of an institutional focal point makes international cooperation in technology challenging unlike other policy domains. Additionally, since digital evolutions are rapid and are intersecting across various domains, a set rule or non-dynamic policy may often prove to be an ineffective approach.[63] However, despite these challenges, there is no denying that the social and economic stakes are much higher within and across nations in this relatively new globalised era.

Complex goods are those which require large inputs of knowledge and a vast network of people while ubiquity refers to the number of countries that make a certain product. In this era of Globalisation 4.0, economies are thriving to become more complex, creating products with a high knowledge quotient, and at the same time creating products that are less ubiquitous to move up the global value chains.[64] In this background, there is no denying that technology is the key driver that could add such characteristics to the BIMSTEC economies.

Endnotes

[1]Achintya Kumar Dutta, “Look East, Act East-II”, The Statesman, 10 July 2019.

[2]Rajeswari Pillai Rajagopalan, “ASEAN-India Convergence: The Geostrategic Realities”, The Diplomat, 26 January 2018.

[3]“What is BIMSTEC and why is it important for India?”, Hindustan Times, 30 August 2018.

[4]Prabhash K Dutta, “Story behind Narendra Modi’s shift from Saarc to Bimstec“, India Today, 28 May 2019.

[5]Rupakjyoti Borah, “India responds to Belt and Road Initiative with infrastructure push“, Nikkei Asian Review, 13 August 2019.

[6] Rajeswari Pillai Rajagopalan, “Beyond Rajapaksa’s Visit, Are India and Sri Lanka Really on the Same Page?“, The Diplomat, 13 February 2020.

[7] Nilanjan Ghosh, “Time for BIMSTEC to realize Potential”, Mail Today, 17 February 2020.

[8] “Areas of Cooperation”, BIMSTEC.

[9] “Fourth BIMSTEC Summit Declaration, 30-31 August 2018, Kathmandu, Nepal”, Ministry of Foreign Affairs, Nepal.

[10]“Report of the Sixteenth BIMSTEC Ministerial Meeting”, Ministry of Foreign Affairs, Nepal.

[11] Klaus Schwab, “The Fourth Industrial Revolution: what it means, how to respond“, World Economic Forum, 14 January 2016.

[12]Globalization 4.0: Shaping a New Global Architecture in the Age of the Fourth Industrial Revolution (World Economic Forum, April 2019).

[13] “Technology”, BIMSTEC.

[14]The E15 Initiative: Strengthening the Global Trade and Investment System for Sustainable Development (World Economic Forum, August 2015).

[15] See supra note 13.

[16]e-Conomy SEA Spotlight 2017: Unprecedented growth for Southeast Asia’s $50B internet economy (Google TEMASEK, 2017).

[17]Anishka De Zylva and Ganeshan Wignaraja, “Is Sri Lanka Sitting on the Bench of Asia’s Booming Digital Economy?” Lakshman Kadirgamar Institute, Policy Brief, 14 May 2018.

[18]“National Digital Policy for Sri Lanka 2020-2025, October 7, 2019” Ministry of Digital Infrastructure and Information Technology (MDIIT) & Information and Communication Technology Agency of Sri Lanka.

[19]Alessia De Bustis, Vidhya Ganesan and Ganaka Herath, “Unlocking Sri Lanka’s digital opportunity“, McKinsey Digital, October 2018.

[20]Jörg Mayer, “Globalization, Technology Transfer, And Skill Accumulation In Low-Income Countries”, UNU-WIDER, Discussion Paper 2001/039, Helsinki (2001).

[21] Ibid.

[22] D.T. Coe and E. Helpman, ‘International R&D spillovers,’ European Economic Review 39 (1995): 859–887.

[23] Ibid.

[24] W. Keller, ‘Are international R&D spillovers trade-related? Analyzing spillovers among randomly matched trade partners,’ European Economic Review 42(September 1998): 1469–1491.

[25] “Digital Nations Group“, Digital Workplace Group.

[26] See supra note 20.

[27] Richard R. Nelson and Edmund S. Phelps, “Investment in Humans, Technological Diffusion, and Economic Growth”, The American Economic Review 56, no. 1/2 (March 1966): 69-75.

[28] Ibid.

[29] See supra note 20.

[30] Ibid.

[31]Anishka De Zylva and DivyaHundlani, “How Sri Lanka Can Enhance the Bay of Bengal Initiative”, The Diplomat, 31 August 2018.

[32] Joe Cochrane, “Indonesia, Malaysia and Philippines to Bolster Security at Sea“, The New York Times, 5 May 2016.

[33]PTI, “Amit Shah to inaugurate India’s first BIMSTEC conference on drug trafficking“, The Print, 11 February 2020.

[34]MI News Network, “Digitalization Wave In The Shipping Industry“, Marine Insight, 1 September 2017.

[35]Review of Maritime Transport 2019 (United Nations Conference on Trade and Development, January 2020).

[36]Andrzej Montwill, “The role of seaports as logistics centers in the modelling of the sustainable system for distribution of goods in urban areas,” Procedia – Social and Behavioral Sciences 151 (2014).

[37]Connected Ports Driving Future Trade (Accenture and SIPG, 2016).

[38] Ibid.

[39]MI News Network, “India To Inaugurate First Ever ‘BIMSTEC Ports Conclave’ In Vizag“, Marine Insight, 6 November 2019.

[40]Jens Riedl, Francois-Xavier Delenclos and Alexander Rasmussen, “To Get Smart, Ports Go Digital“, Boston Consulting Group, 11 April 2018.

[41] Ibid.

[42]“Country Score Card: Sri Lanka 2018“, The World Bank.

[43] Ibid.

[44] “Colombo Port“, Sri Lanka Ports Authority.

[45] “Colombo Ranked Highest Growth Port by Alphaliner“, The Maritime Executive, 13 September 2018.

[46] Inoka Perera, “South Asia’s logistical hub: Challenges and opportunities for Sri Lanka’s transshipment future“, LSE South Asia Centre, 21 June 2019.

[47] “Sri Lanka: The Next Maritime Logistics And Distribution Hub In The Indian Ocean”, Sri Lanka Export Development Board, 26 December 2018.

[48] Ibid.

[49] See supra note 46.

[50] “Information Fusion Centre – Indian Ocean Region“, Indian Navy.

[51] “For a more tech-driven Bangladesh“, Dhaka Tribune, 23 February 2020.

[52] Natasha Fernando, “Sri Lanka’s Maritime Security Dilemma“, South Asian Voices, 16 August 2019.

[53] Ibid.

[54] Gurpreet S Khurana, “BIMSTEC and Maritime Security: Issues, Imperatives and the Way Ahead“, National Maritime Foundation, 16 November 2018.

[55] Mayank Singh, “BIMSTEC nations meet to enhance maritime security“, The New Indian Express, 21 November 2019.

[56] “Using Technology To Bridge Maritime Security Gaps“, National Infrastructure Institute Center for Infrastructure Expertise.

[57] See supra note 9.

[58] See supra note 37.

[59] Leah Kinthaert, “Digital Transformation: How Will it Change the Seafarer’s Role?“, Informa Connect, 4 September 2017.

[60] Ibid.

[61] “Disruption ahead: Technology’s impact on shipping industry“, SAFETY4SEA.

[62] See supra note 11.

[63] See supra note 12.

[64] Ricardo Hausmann and César A. Hidalgo, “Country Diversification, Product Ubiquity, and Economic Divergence”, HKS Faculty Research Working Paper Series, RWP10-045, John F. Kennedy School of Government, Harvard University (2010).