While Bangladesh is not heavily indebted, it joins several such countries in loosening a tight grip on local currencies in order to get financing from the Washington-based lender. Pakistan, Egypt and Lebanon were among those that have dropped their fixed exchange rates this year.

Street vendors under umbrellas to take shelter from the sun during high temperatures in Dhaka, Bangladesh, on Wednesday, May 10, 2023. Climate change is raising temperatures and making heat waves more frequent and more acute. Factor in humidity, and extreme weather is already testing the limits of the human body.

Bangladesh’s central bank will allow the currency to float freely for the first time in the country’s history, giving into demands from the International Monetary Fund in order to unlock more money from the $4.7 billion loan program.While Bangladesh is not heavily indebted, it joins several such countries in loosening a tight grip on local currencies in order to get financing from the Washington-based lender. Pakistan, Egypt and Lebanon were among those that have dropped their fixed exchange rates this year.

The new market-driven exchange rate regime will provide “greater transparency and efficiency in foreign exchange transactions, benefiting businesses, individuals and the economy,” the Bangladesh central bank said in a statement on Sunday. It also doesn’t see any major depreciation of the taka, which has declined about 5% this year.

The taka declined as much as 0.9% to 108.86 per dollar on Monday. The broad index of Dhaka Stock Exchange rose as much as 0.3%, most since June 7.

Since becoming an independent country in 1971, Bangladesh has made use of a series of fixed exchange rates to manage volatility and keep imports affordable. A looser currency regime could now help replenish Bangladesh’s reserves by raising the attractiveness of the nation’s exports.

Bangladesh Bank will now adopt a unified exchange rate regime between the taka and the dollar or any other foreign currency and from July 1, it will no longer sell any foreign exchange at a discounted rate. By the third quarter of 2023, all international transactions will be based on the new exchange rate structure and this will close the gap between formal and informal markets, the central bank said.

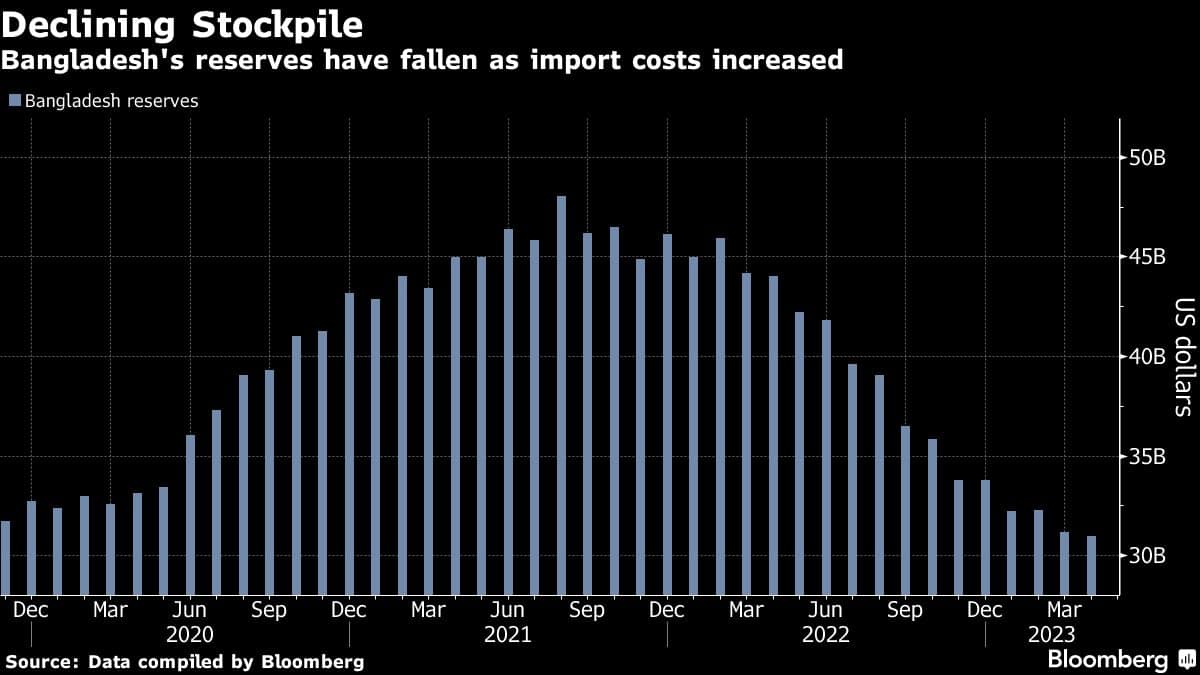

The central bank has sold around $13 billion so far in the fiscal year ending June 30, due to increased demand for foreign currency.

“If there’s no major price shock in the international market, the taka will remain largely stable,” said Salim Afzal Shawon, head of research at BRAC EPL Stock Brokerage Ltd. “Our analysis suggests that the exchange rate is showing less volatility as global commodity prices show signs of stability.

The government received $476 million as the first installment of the IMF loans in February, while the disbursement of the second tranche is expected in November. Prime Minister Sheikh Hasina has said her country is in a position to pay back the loan taken from the IMF, saying the lender only gives “assistance to countries that can repay their bill.”

Last month, Moody’s Investors Service downgraded Bangladesh’s ratings to B1 from Ba3 as the economy weakened amid “heightened external vulnerability and liquidity risks.” The central bank has dismissed the action, saying there will be limited impact because the country hasn’t issued sovereign bonds.

Tight Policy

Bangladesh is seeking a path to boost economic growth to 7.5% for the next fiscal year starting July 1 and eventually graduate from being a least developed country. But inflation remains a major concern due to pandemic-related spending, soaring commodity prices and the weaker taka.

Consumer prices rose 9.94% in May, overshooting the average inflation target of 6% while the government sees 6.03% growth estimate for the current fiscal year, led by a “deceleration” in industries, services and agriculture.

The central bank “will adopt a tight monetary policy” for the first half of the new fiscal year Bangladesh Bank Governor Abdur Rouf Talukder said. He made the comments after raising the repurchase agreement rate by 50 basis points to 6.5% and the standing deposit facility by 25 basis points.

Bangladesh Bank also introduced a market-driven reference lending rate for all types of bank loans, replacing the three-year-old lending rate cap that helped to keep easy credit available for private businesses.

“This approach provides utmost priority to containing inflation to the desired level while ensuring the necessary flow of funds to productive and employment-generating sectors to support the targeted economic growth,” the central bank said.