To sustain economic growth, central banks in advanced economies have steadily reduced interest rates, encouraging consumers to spend. About 30 percent of the world’s investment-grade securities is in negative rate territory – which means lenders and savers pay others to use their funds. But economies are not so easily moved. “Cheapening money to incentivize economic activity is no longer working,” explains author Will Hickey. “European central banks in particular are out of ideas to jump-start economic activity. The near negative and declining interest rates in developed countries around the world have caused the dollar to soar, which has a knock-on effect in developing countries like Indonesia, Turkey and Nigeria that have borrowed heavily in dollars and must repay them from earnings in local currencies that have steadily devalued.” Negative rates are especially harmful for pension funds and the retired who rely on interest income. One economist warns against US reliance on negative rates, which could destabilize the banking system. New ways to spur economic activity are needed, and that includes innovation. – YaleGlobal

Global Economy Struggles With Negative Rates

Japan and the European Union use negative interest rates to maintain feeble economic growth, but reducing rates that low for the United States could destabilize the banking system Will Hickey Thursday, November 7, 2019

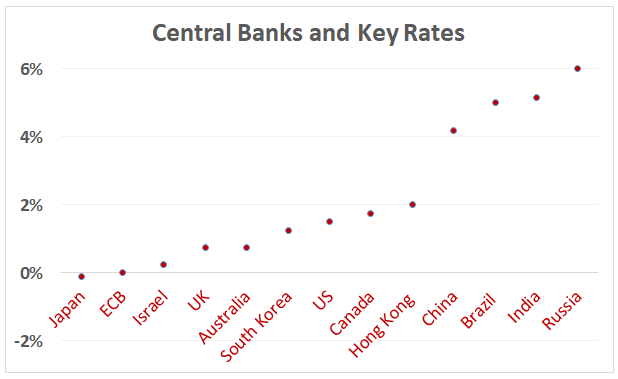

CANTON, CHINA: The world is confronting negative interest rates, a dilemma for savers who must pay banks to keep their money. This trend is accompanied by inverted yield curves, with interest rates paid for a short-term loan of a few weeks or months are higher than rates over the course of years. Both negative interest rates and inverted yield curves have loomed over world markets since the 2009 financial crisis. Today nearly $17 trillion or 30 percent of the world’s investment-grade debt issuance – including bonds, sovereign notes and more, mostly held in the European Union and Japan – is in negative rate territory and growing.

The Swiss pioneered negative interest rates in the early 1970s after the United States abandoned the Bretton Woods’ gold standard and the US dollar cratered. Investors everywhere, frantically seeking a stable currency that was not easily devalued, poured money into the franc, causing its value to soar and wreaking havoc on Switzerland’s economy. The Swiss central bank tried many unorthodox moves throughout the decade to stem capital inflows, but to no avail. Not until 1982, with exponentially rising interest rates in the United States, did money inflows into Switzerland stabilize.

Today’s situation is different, with central banks using negative rates to spur any type of economic activity – forcing consumers not to hold cash for tomorrow, but rather spend and borrow today. The Bank of Japan, traditionally the poster child for a near-zero rate scheme, has been eclipsed by Europe, where negative rates were used by Sweden in 2009. The trend is most profound in Denmark, where negative rates now force negative home loans: The bank pays homebuyers to take a loan where they can expect to pay back less than the principal amount over time. Amid rising prices, home ownership is in decline. In Switzerland, accounts with large cash deposits now pay monthly fees, instead of being rewarded with any interest. Germany has a term for this penalty, strafzins.

Of course, there is no “free lunch” with negative home loans. Banks eventually recoup lost interest over time with various fees for loans. And the outcome is stalled credit expansion. Cheapening money to incentivize economic activity is no longer working. European central banks in particular are out of ideas to jump-start economic activity. The near negative and declining interest rates in developed countries around the world have caused the dollar to soar, which has a knock-on effect in developing countries like Indonesia, Turkey and Nigeria that have borrowed heavily in dollars and must repay them from earnings in local currencies that have steadily devalued.

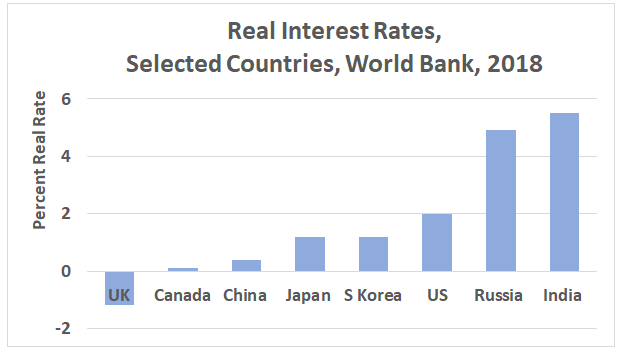

Negative rates have a mal-effect on consumers and savers, though “real rates,” which account for inflation, are what they ultimately feel. Cheaper money does not necessarily filter down to the consumer at a retail level. Banks with interest-rate shortfalls in a world of near or actual negative rates will charge their customers higher fees for any service, whether overdrafts or use of out-of-network ATMs. Savers, in particular older people who rely on interest income receive nominal payments for saving, and struggle to make ends meet. About 25 percent of Europeans and 30 percent of Japanese are aged 60 or older. More alarming, pension funds – historically conservative investors – struggle to meet benchmarks of 7 to 8 percent returns, a common threshold for solvency, so shortfalls are emerging.

The big test may be if the United States as the world’s largest economy tries negative rates. Allianz Economist Mohamed El-rian said recently, negative yields in the world’ largest financial market would “break things.” By break, he means a systemic failure or bank collapse. Setting interest rates at zero or negative confounds long-term investment decisions.

US President Donald Trump frequently complains about the Federal Reserve’s reticence on reducing rates more quickly while other countries lower theirs, putting the US economy at a cost disadvantage with an overvalued currency. Nonetheless, marginally higher rates of Treasury and bond issues, guaranteed by the US government, make the country an investment magnet for the rest of the world.

There is a thirst for returns. Like lost travelers in a desert seeking water, bankers and managers of pension, insurance and investment funds around the world are desperately seeking “yield,” or passive income on vast holdings. Similar to distressed travelers, investors make risky decisions during times of despair, such as drinking from tainted pools of water, which can have dire costs. Namely, negative rates push investors into riskier bets including private equity, junk bonds and speculative grade “emerging economy” assets.

Risky bets have reintroduced the concept of borrowing low in currencies that offer low interest rates, such as the dollar or yen, and then investing in currencies with high interest rates, such as the New Zealand dollar or Argentine peso. This is known as the carry trade, which is lucrative as long as the invested currency remains stable. If significant currency depreciation or large devaluations occurs, the losses can easily outpace any potential higher interest rate gain and eat into capital, albeit in dollar terms. For example, Argentina peso bank deposits currently pay over 50 percent interest, which seems like an astronomical amount until one considers the peso also lost more than half its value against the dollar in 2018, effectively zeroing out any real currency gains in US dollar terms. As of this writing, the peso has continued to depreciate with a newly elected Peronist government.

Global investors who can still access positive rates wonder anyone why would hold onto negative-rate bonds. Investors with a few hundred euros can hold on to cash, but brokerages, banks and nation-states cannot physically store billions of dollars in other currencies, and many may simply not trust having it on active investment ledgers during volatile times. Major holders must put their wealth somewhere safe, and sovereign bonds are a good bet, which also traded digitally. Recently the €500 note has made a resurgence in Germany and Austria. While no longer being printed, the note is still exchangeable and allows easy high-value storage for consumers. If people are penalized for saving money, instrumentality becomes key. This same rationale applies to the Swiss franc 1000 note – a recent Financial Times article recommended storing them in safe deposit boxes in a cash-obsessed world with negative rates.

The overall economic consensus has been that negative interest rates simply do not work as expected. New ways to spur economic activity are sorely in need. Options include reducing regulations on small business creation and opening up behemoth state-owned enterprises to private competition.

Many countries, particularly in the developing world, seek more value-added activity, but cling to top-heavy bureaucracies, red-tape and monopoly state-owned companies that create stability rather than initiatives to unleash entrepreneurial animal spirits, as described by George Akerlof and Robert Shiller. In the digital age, crypto currency such as Bitcoin or Facebook’s proposed Libra project, artificial intelligence, 5G integration and other constructs are forcing cross-border activities not beholden to any sovereign-state, allowing individuals to communicate and create directly and freely. A better store of value beyond dollarized paper currency dictated by central banks or politically compromised monetary unions is where the future may lead.

Will Hickey is a former Fulbright, and Visiting Professor with Guangdong University of Foreign Studies, Canton, China. He is also author of Energy and Human Resource Development in Developing Countries: Towards Effective Localization, Macmillan, 2017.

The article appeared in the Yaleglobal online on 7 November 2019