by Rajesh Kumar Sinha 6 February 2021

In the midst of distressing economic signals India is going through in the last few months, one very positive development has occurred on the foreign exchange (forex) front. The development is extremely critical when it is seen in the context of two important factors. One, it is the same forex story that in 1991 brought the country, on the brink of bankruptcy and India was forced to mortgage gold with Swiss banks. And two, India today is among the first five (could become the fourth one soon) with its forex reserves in a country of 193 nations.

There was a time in 1991 when Indian economy was in a big mess. The competitive coalition politics had brought the country on the brink of socio-economic disaster. India was left with a forex reserve of worth three-weeks imports at that point of time. Foreign Direct Investment (FDI) was extremely limited while economic reforms were virtually non-existent. The economic roadmap was nowhere to be seen and country was forced to accept the stiff conditionality imposed by the IMF to secure loans.

Fortunately, compelled by such adverse circumstances, India was made to move ahead with economic reforms. And though coalition politics continued for next 23-years, each successive government was forced to pay heed to economy and initiate some kind of economic reforms. Though politics and social issues continue to dominate the electoral discourse yet for the first time, economic issues inflation, employment, infrastructure, better living standards come to play a major role in the national politics.

The economic reforms initiated and pursued in the post-1991 scenario has resulted in making the Indian economy more dynamic, resilient and progressive. While the credit for ushering in unthinkable reforms in the form of downsizing public sector, promoting entrepreneurship and privatization, competition and efficiency goes to the then fiancé minister (later Prime Minister) Dr Manmohan Singh, doing so with a minority government and against all political odds, it was undoubtedly P V Narasimha Rao who gave a paradigm shift to Indian economic and foreign policy during his tenure.

Since then, Indian economy has grown and become more dynamic. Indians have become more entrepreneurial, a great number of new and innovative businesses have come up and micro, small and medium enterprises (MSME) have come to play a major role in country’s economy and exports. Road, Ports, airports and telecom infrastructure has improved drastically and economy has become more transparent, competitive and efficient.

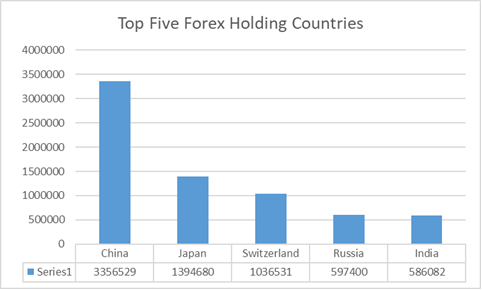

Seen in this context, recent reports about India continually enhancing its forex reserves and emerging as the fifth largest forex holding country in the world, assumes significance. While the global economic activity has seen an unprecedented decline due to Corona virus pandemic, since March 2020 India’s forex has gone up from US$ 477Billion to US$ 586Billion in the first week of January this year.

This remarkable surge in forex has been attributed to a number of factors including the tremendous fall in price of petroleum products of which India is the world’s third largest importer. Yet there have been a number of other negative developments that could have hit country’s forex position adversely. In the aftermath of Corona pandemic, the global economy is still undergoing bouts of uncertainty and slowdown. Tariff wars have been going on between major global economies, financial markets have yet to stabilise, geo-political and strategic tensions have increased.

In India too, economy has shown signs of improvement but is yet to reach a stage of full-fledged recovery. Domestic political and social tensions, including farmers’ agitation are there while borders on the China and Pakistan, both fronts are elusive. In such conditions, the risk-averse global investors are unlikely to put in their money in unstable economies. The fact that in the midst of all this, India has been able to attract a significant US$ 30Billion in foreign direct investment (FDI) in the April-September, 2020 period is suggestive of the fact that the country has remained among the leading favourable destinations for global corporates. Further, during the last 20-years period, April 2000-September 2020 the total FDI India has crossed US$ 500.12Billion while Ernst &Young (E&Y) report has predicted enhanced FDI levels of US$120-160Billion in India each year by 2025.

Another important significance of India’s surging forex reserves is that while Rangarajan and Tarapore Committees suggested holding minimum forex to the tune of 3-6 months’ imports, current holdings account for more than 14-months of country’s imports. It certainly gives a big cushion against rupee volatility to India’s central bank, Reserve Bank of India (RBI). Also, it provides big confidence to global rating agencies and investors about country meeting its external obligations, wholly and effectively. One can see the contrast with neighbour Pakistan whose forex at US$ 19Billion (including loans from China, UAE) has forced iron brother China to rethink its further investments in the country and it being compelled to even mortgage its airports, parks and power companies to secure loans.

Strategically too, a high forex reserves allow India to be ready to deal with any kind of economic or strategic contingencies. Thus while borders with China remain tense yet India, its government and people seem confident of dealing with any kind of strategic scenario, if and when that emerges from either sides of northern or western borders.

***

Rajesh Kumar Sinha, MA, MLISc, MPhil, PG Diploma in Journalism is a serving Librarian with the Indian Railways, INDIA. He has worked in print and web media for seven years and writes for Foreign Policy News (US), South Asia Journal (US), Modern Diplomacy (Germany), Eurasian Times, OPEN Journal, Indian Railways (India) and Rail Journal (India).