The man who transformed the structure of excise and customs duties in India

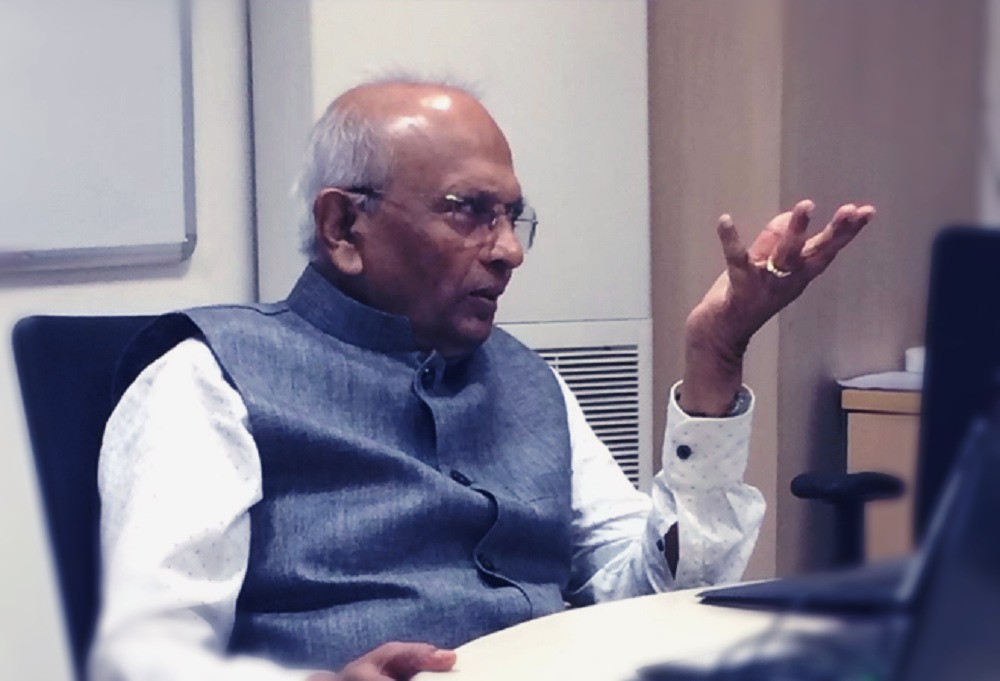

former Revenue Secretary M R Sivaraman speaks out.

by Nilantha Ilangamuwa 22 June 2022

“Dr. Singh allowed me to formulate all taxation reforms and I worked them out with some brilliant officers of the Indian Revenue Service,” he recalled when I asked about the secrets behind the success in solving one of the most difficult economic crises India ever encountered. In his mid-twenties he was the youngest collector ever in India and his journey is a very important trail to understand what India is today. Revenue Secretary M R Sivaraman, who transformed the structure of excise and customs duties in India, shared his experiences not only on his personal journey but also on the institutions he worked for, including the International Monetary Fund.

Joining the I.A.S. cadre of Madhya Pradesh in 1962 Mr. M. Sivaraman Ramanathan has worked in various departments in the state of Madhya Pradesh and the Central Government. With over 40 years of experience he has held important positions at various levels in the Department of Finance, Planning, Finance Commission, Economic Affairs and Ministry of Commerce and Finance. He has worked as Director General of Civil Aviation & Ex-Officio Additional Secretary of Government of India, Ministry of Civil Aviation & Revenue Secretary, Government of India, Ministry of Finance, New Delhi. He has also worked as Executive Director, International Monetary Fund and was an expert Adviser to the UN Security Council Committee to Counter Terrorism. Currently he is engaged in delivering lectures on Budget, Banking, Fiscal and Monetary policies. While talking the crisis in Sri Lanka he says, “Sri Lanka should not be attracted toward models of other countries. There is a temptation that the Chinese model is great or the American model is superb. These countries do not offer assistance for charity and they have their own agenda.” Acclaimed author on fiscal and monetary policy issues Mr. Sivaraman reaffirmed that, “dynasty rule should be avoided at all costs,” while indentifying the foundation for a regime that sincerely respects liberty, equality, fraternity without hesitating to admit the India’s mistakes in the past in dealing with certain issues in Sri Lanka.

Excerpts of the interview;

Question: Mr Sivaraman, as a Chinese saying goes, we are living in an interesting time. Aren’t we? The unpredictability of social calamities is becoming the norm. I, most of the time, was surprised to realize the gravity of the old Hegelian saying later popularized by Marx, “history repeats itself, first as tragedy, second as farce.” Let’s start this discussion on your early years as a dynamic youth. Born in British India in the 1940s and became the youngest collector ever in India at the age of 25, your footprints are a trail of what India today, as one of the main economies on the planet. Let’s recall your early professional experiences and challenges such as corruption and bribery you saw, and how do you overcome them?

A: My first encounter with corruption was when as an assistant collector I was asked to trap a corrupt forest range officer.

The man who was asked for the bribe carried marked currency notes to the RO in a remote forest guest house and I was (all of 23 years) was waiting behind a tree near the guest house at around midnight. As soon as the notes were handed over to the RO I pounced on him with a few cops and arrested him. He tried to set his dog on us but it was caught. Then when I was collector I had caught red -handed, a senior Government of India official with a hefty bribe in his hands. Corruption is endemic in every society in different forms. There is also moral corruption when you see something going wrong and you do not stop it for fear of personal consequences. This is the worst form. In my 39 years service I was never afraid of speaking the truth almost following the Kantian categorical imperative excepting when I had to deal with my country’s safety. I had not tolerated corruption in my vast revenue department as its permanent secretary and sent a few to jail and a few I dismissed from service using a rarely used constitutional provision and my orders were upheld by the courts also.

Q: India faces several financial downturns. One of the known scenarios was during the late Prime Minister P.V. Narasimha Rao’s tenure. Political instability was on a rampage, social insecurity is at the helm and the forex balance was shaking. But, Rao’s political wisdom changed the fate of the nation. He took the firmed decisions to restructure the Indian system to benefit all walks of the society. Everybody knows, that his handpick Dr Manmhohan Singh was the man behind this remarkable achievement. However, it is a smokescreen that an individual thinks that he/she alone can succeed in complicated social issues without the genuine support of a reliable and efficient team. You were the Revenue Secretary of India when Dr Singh was the Finance Minister. I know you have discussed the secrets behind this success story in many national and international forums. But I would like to have glimpses of your role and memorable incidents that you could like to recall today?

A: I had known Dr. Manmohan Singh since 1977 when I joined the Department of Economic Affairs as Director and he was my Secretary. Later he was instrumental in my getting posted as Joint Secretary there giving me opportunities to lead many intergovernmental talks and also accompany the PM on her state visits. Dr. Singh allowed me to formulate all taxation reforms and I worked them out with some brilliant officers of the Indian Revenue Service. Never did he reject any proposal of mine in the 4.5 years we were together. On one occasion I had a serious difference of opinion with him in the matter of relieving from the post of chairman of a Tribunal (equal to a High Court Judge in India) I relieved him using my position as administrative head of the Department and Dr.Singh was under political pressure to continue him not because he considered him worthy but the pressure was intense including from the PM. I declined and offered to proceed on leave. He then took the papers, studied them and agreed with me and told the PM that he would not like to overrule me. The PM P V Narasimha Rao did not overrule me. Dr.Singh was gentle and humane and kept a clean conscience as Finance Minister.

Several political luminaries including senior Cabinet Ministers came under a cloud with the SC monitoring a case of corruption under investigation by my department. Never ever I was asked to do anything contrary to my conscience and some of the cases involving surviving politicians are still pending in the court.

In my 36 years of service in the IAS never had I done anything against my conscience and nobody ever asked me to do anything. Mr. Arjun Singh the CM of MP had to quit because of a court judgement that upheld my view as correct opposing a cabinet decision. Even opposition party chiefs were always happy with the actions being taken by me. On a few occasions there were differences of opinion between me and Montek Singh Ahluwalia Secretary Economic Affairs but invariably Dr. Singh went along with me and so did Ahluwalia.

When I approved action against Sasikala the friend of Jayalalitha then CM of Tamil Nadu there was uproar in TN and a few people committed suicide. The PM who had the support of Jayalalitha did not stop me. Was it sheer luck or a considered decision by the PM and the FM to stand by me in my tough actions so that the people of India would know that the govt. will allow rule of law to take its course.

I would not know. But this puts the two political leaders on a pedestal at least during my time. Consistency in such an approach makes a person a great leader. But many fall on the wayside, unable to resist pressures or suffer personal consequences.

Q: You have redesigned and reengineered the function of the Central Excise and Customs of India. Why did you think it was such an essential area that needed to be addressed immediately?

A: The Customs and Central Excise department was characterised by corruption and the only way to reduce it was by making it rule based by removing discretion and all other changes in the tax system were toward that end. When for the first time the Delhi customs was to go online in a new building the construction of which I had supervised the then current Chairman would not come for its inauguration by Dr. Singh when four other former chairmen were present. He thought that it was my project an IAS officer’s and so he should boycott it. While all the 4 former chairmen lauded the effort this gentleman was absent. He was fired by Dr. Singh later when he refused to attend to even budget files. The Custom House Agents tried to sabotage the system with the assistance of subordinate customs officials whose outside incomes disappeared. But we did not budge. Similarly computers were introduced in the management of Central Excise also.

The Permanent Account Number (PAN) was introduced during my time and now it is ubiquitous in India, a dream of mine that has been realised. It is also the basis of the registration for the GST also which I had suggested when the PAN became a reality. This wholesale computerisation removed discretion at the hands of officers and drastically reduced corruption, speeded up procedures facilitating commerce and business and reduced transaction costs. Dr. Singh supported every one of these decisions. Today India’s taxation system is computerised from end to end thanks to the initial unfailing support by Dr. Singh and also the PM. Today’s GST Council of India has its origin in the first State Finance Minister’s conference organised under Dr. Singh to consider the introduction of the VAT in all the astes.

Q: Before we are going talk about your experiences at IMF, let me ask you about an existing socio-political issue on political leadership in South Asia and elsewhere. As Plato quoted Socrates, “no man chooses evil because it is evil; he only mistakes it for happiness”. I find this statement is remarkably true, not only in ancient Greek but its validity holds even in most of the social affairs today. Mr Sivaraman, Why do leaders fail, though they tried their best to revamp the rotten system?

A: Reforms have to be thought out in all its dimensions of their short, medium and long term impact on a nation’s people and also its external ramifications. When a government has formulated reforms with those considerations in view Leaders who do not devote their heart and soul in implementing those reforms and who are morally imperfect fail. This is true also of Bureaucrats who implement reforms and Political leaders who defend them in public and parliament. A leader must have a high moral calibre that he/she is incorruptible, courageous enough to sacrifice, put public welfare above self and be above suspicion. In today’s world you have to search to find one unfortunately.

Q: After successful years in Indian Administrative Service, your next hold was in International Monetary Fund (IMF). What triggered you to join the IMF? Who are the remarkable economists you worked with?

A: Mr. P C Chidambaram a brilliant lawyer every inch an aristocrat succeeded DR. Singh as the Finance Minister but from a different regional political party of TN having resigned from the Congress.

I had a very good equation with him and we put through one budget together.

I never looked for any major assignment as I was certain that I had no political back up. But surprisingly Chidambaram called me in June 1996 and asked me why I had not approached him for a posting in the IMF or the Word Bank as ED, both the posts being vacant. I told him I was not aware of those vacancies. So I also offered to be considered. But after a few hours Mr. Chidambaram called me and said the PM Deve Gowda and some members of the cabinet wanted me to be the next Cabinet Secretary. I was taken aback as there were a few seniors in the service. Chidambaram told me that the seniors have been considered and were rejected and two of them could be appointed to the IMF and the WB. I told him I would accept whatever the government offered me. But political pressure mounted on the PM for Cabinet Secretary’s post as well as for the others. Finally the PM called me and said that he was making TSR Subramanian a 1961 batch officer and senior most, although with only 3 months service left as the Cabinet Secretary. He was a fine officer and richly deserved the post. So I had to choose between the World Bank and the IMF.

Montek Ahluwalia a fair man told Chidambaram that I should be sent to the IMF as there one had to actively participate in policy making and will be confronted with the views of some of the world’s leading economists and Surendra Singh the outgoing Cabinet Secretary not an expert in financial management who had been promised one of the posts by PM P. V. Narasimha Rao should be sent to the World Bank. That is how I got posted to the IMF.

Q: When you listen to many talks in day to day discussion it’s clear that many people do not know much about what IMF is and its structural functionality. Correct me if I am wrong, IMF is not a charity but another bank with enormous commitments and different capabilities compared to our local banks. It borrows money from various nations to make it work and lends guarantees or other financial packages to countries in need. So my question is what are the basic principles you need to keep in mind when you approach the IMF for relief?

A: The IMF is an institution which basically tries to maintain the International Monetary System and exchange rates stable, for an orderly conduct of global trade and prevent crises in one country affecting other countries. That is why the Fund has Article IV consultations with member countries built into its charter. In most cases it is an annual exercise and in some it may have different periodicity also. These consultations enable the Fund to evaluate a country’s policies from global a perspective as well from its national objectives. Its advice is not mandatory supplies but the Fund cautions a country when it sees dangers ahead.

When one approaches the IMF for assistance a country has to be sure that they may have to renounce populist decisions and adopt policies that initially may be unpalatable like pricing power and other forms of energy supplies like petrol and diesel at economic cost. Reform sales and income taxation to ensure that they are collected properly. To take measures to promote exports by having realistic exchange rate and monetary policies. On the fiscal front governments have to give up profligate policies. IMF these days are careful to ensure that their conditionalities do not affect the poor. Governments can negotiate conditionalities with the IMF.

Q: Do you think IMF is the panacea for the economic downturn? What are the success stories of IMF?

A: The IMF is not a panacea for all crises. IMF succeeded in the SEA crises by arresting the exit of international banks from the affected countries even though critics condemned many conditionalities of the IMF. I was there and some measures I had opposed myself. The IMF realised its mistakes as can be seen in the evaluation report on its performance during the crisis.

Q: Among other accounts, I was engrossed by a critical analysis of IMF and World Bank where the authors suggested these organizations are turning poor countries into loans addicted countries. I quote, “Once countries accepted the conditions of structural adjustment, the World Bank and the IMF rewarded them with still more loans, thus deepening their indebtedness—rather like a fireman pouring gasoline on a burning house to stop the blaze.” What do you think? Is there an example you would like to tell that the IMF could have done better than they did?

A: Some criticisms of the IMF are valid as the economists there are mostly theoreticians and have had very little practical experience in handling crises of any country. There are very few, probably none in the IMF who has been a Finance Secretary of a country handling such a crisis. Mere theoretical solutions to every crisis do not work as economics is not an exact science.

Q: Mr Sivaraman, let’s talk about Sri Lanka. I’m sure you need no foreword about the situation in Sri Lanka. You are one of the few who have in-depth knowledge reference to economic condition in this beautiful Island nation, your immediate neighbor. How do you read the situation, and what went wrong here in Sri Lanka?

A: I had the honour of representing Sri Lanka in the IMF. It is a beautiful country which successfully controlled its population, achieved near universal literacy, promoted health of every citizen and was attracting the attention of tourists and also administrators elsewhere on its success in achieving a satisfied society.

But political struggles amongst various groups became intense after the elimination of the LTTE. Actually, the return of peace should have catapulted the country to higher growth. This did not happen as the country could not resolve the Tamil issue. The hatred for Tamils by the Sinhalese and vice versa if not eliminated Sri Lanka will never be able to achieve its full potential. Both Tamil leaders and other leaders in Sri Lanka have to adopt a policy of give and take. Tamils must think as Sri Lankans and Sinhalese too have to cease being Sinhalese and be Sri Lankans. They cannot fight as they say like kilkenny cats as then only two tails will be left.

Q: You and one of the known intellects with whom I was fortune to keep fruitful communications for decades, Dr V Suryanarayan from the University of Madras, recently wrote an article about the Sri Lankan situation. The article ended by quoting the famous lines of Shakespeare in Macbeth echoes in our minds: “Alas, poor country, almost afraid to know itself. It cannot be called our mother, but our grave …” This, I believe, is an attempt to get the worse scenario correct. What is the way out? Apart from giving priority to monkey politics, how can the country’s resources be mobilized to overcome this tragic situation?

A: Sri Lanka should not be attracted toward models of other countries. There is a temptation that the Chinese model is great or the American model is superb. These countries do not offer assistance for charity and they have their own agenda. Similarly putting one country against another is a game that should be avoided. You may ask what about India. Yes India has its own interests to protect like it does not want to have countries hostile to it having bases economic or military in its neighbourhood.

I know India’s record dealing with the LTTE has not been correct to say the least. But neither India nor Sri Lanka can forget that they are linked for over 2000 years culturally and historically. History may contain many mistakes but they have to be forgotten and move on for a better future.

India has a moral responsibility to ensure peace and stability in Sri Lanka so that its people live in peace.

As regards Sri Lanka’s future I would strongly advise that when once the situation stabilises fresh elections should take place and Sri Lanka should have a Cabinet controlled government accountable to its Parliament with a President as its titular head having limited powers. Dynasty rule should be avoided at all costs. I am not prescribing any measures for its economic stability as I do not have full details on its economy.

Nilantha Ilangamuwa is a journalist and author. He is former editor of Sri Lanka Guardian.

Photo Captions:

M. Sivaraman Ramanathan is delivering a lecture in Chennai (Photo Special Arrangement)

- (from left) Expenditure secretary K. Venkatesan, minister of state for finance Chandrashekhara Murthy, revenue secretary M.R. Sivaraman, finance minister Manmohan Singh, finance secretary Montek Singh Ahluwalia and chief economic adviser Shankar Acharya, in 1994. (Courtesy HarperCollins India)